To understand how the quality of customers’ experiences varies across industries, XM Institute conducts annual large-scale U.S. consumer studies. As part of these studies, we ask respondents to rate their recent interactions with hundreds of organizations across more than 20 different industries. In this blog post, we examine the state of customer experience (CX) in the retail banking industry.

Banks Provide Suitable Experiences

To generate the XMI Customer Ratings – Overall average score for each industry, we asked respondents to evaluate their experiences with organizations over the previous 90 days. These questions – rated on a seven-point scale – covered the three components of an experience: success (were they able to accomplish their goals?), effort (how easy or difficult was it for them to accomplish their goals?), and emotion (how did the interaction make them feel?). To produce the XMI Customer Ratings – Overall scores for each of the organizations included in these studies, we average the scores for each of these three experience elements. We then calculate the XMI Customer Ratings – Overall for each industry by averaging the individual Ratings of the organizations within each industry.

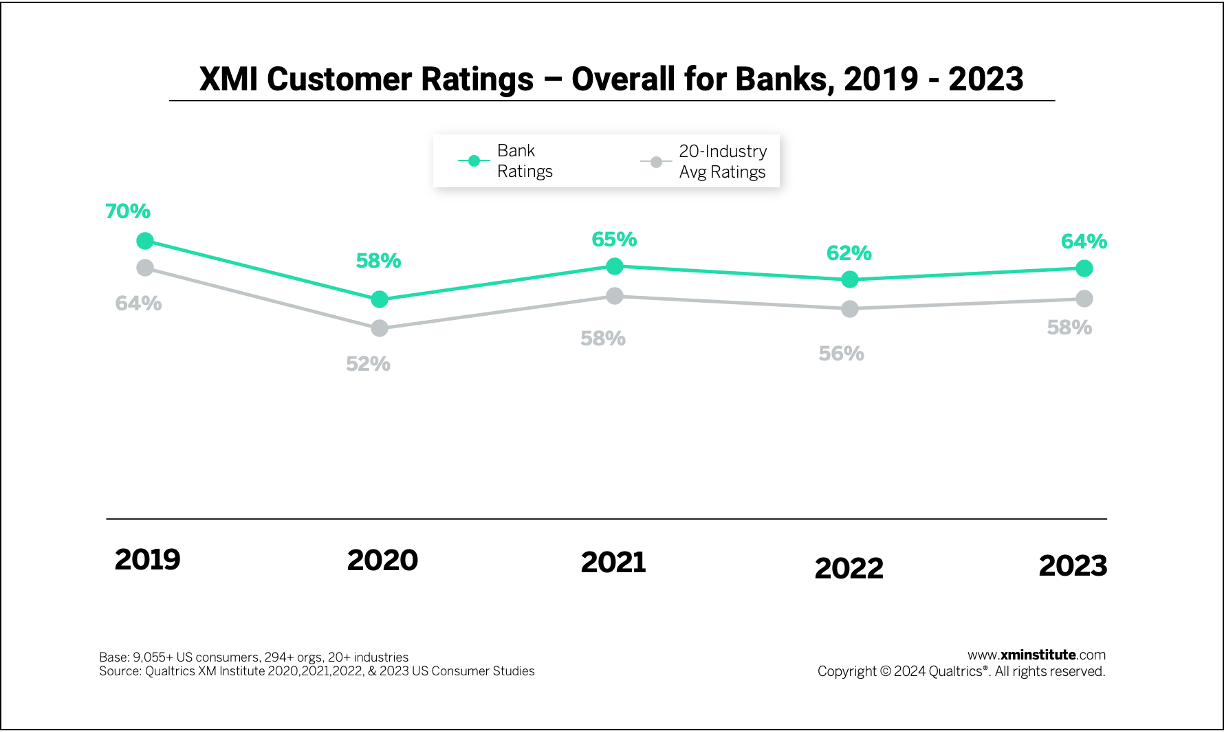

Compared to other industries, we found that banks have received above-average XMI Customer Ratings – Overall scores over the past several years.

When it comes to overall customer experience performance, we found that banks:

- Received an average rating of 64%. In our 2023 US Consumer Study, banks received an average XMI Customer Ratings – Overall score of 64%, the sixth highest rating out of the 20 industries included in this analysis.

- Consistently perform above average. Over the past few years, banks’ ratings have remained relatively stable, decreasing just one percentage point from 2021. Their ranking compared to other industries has likewise remained fairly constant. Banks ranked 3rd in 2019, 7th in 2020, 5th in 2021, and 6th in 2022.

- Have dropped since 2019. Since 2019, a high point for banking and cross-industry customer experience alike, the average industry score for banks has dropped six percentage points. However, banks are not alone in this decline. Of the 20 industries consistently included in this study, 16 of them have seen their ratings decrease since 2019, leading to a cross-industry average drop of six percentage points over the last five years.

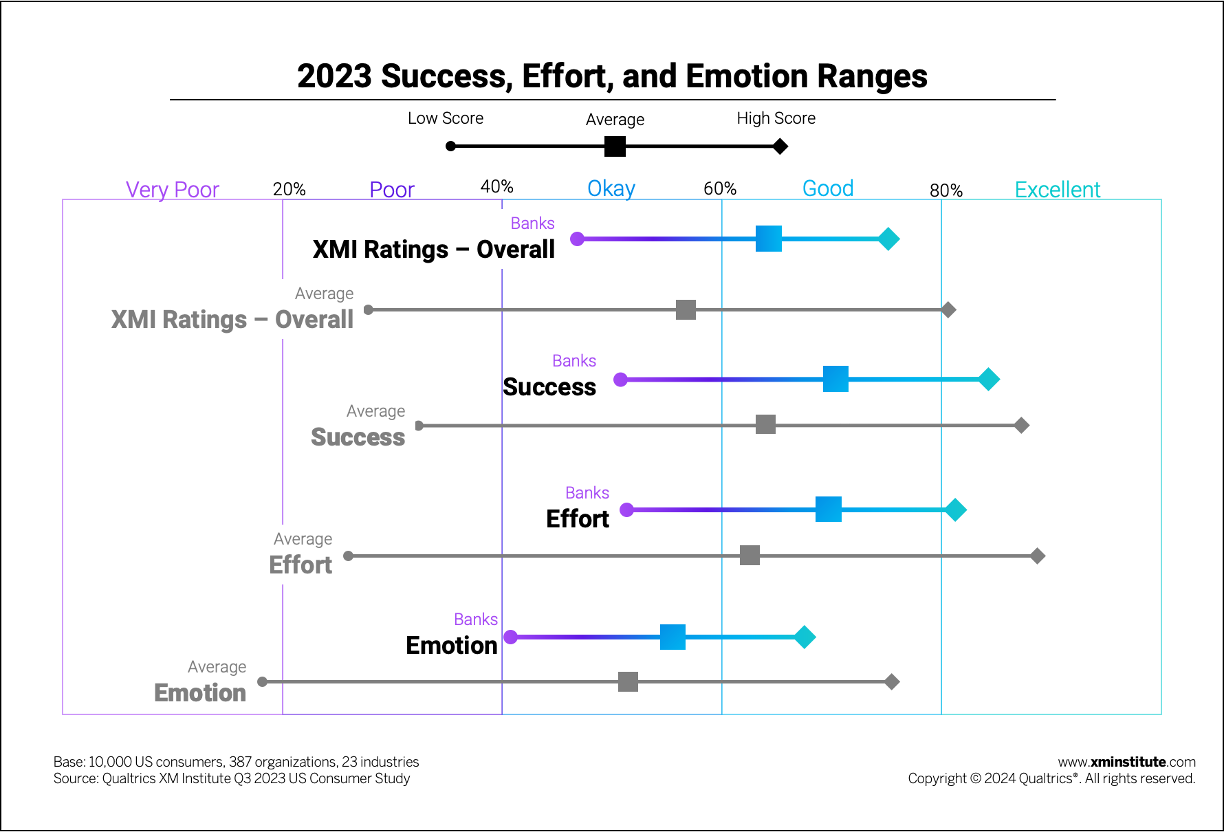

We also examined how banks performed in 2023 across each of the three individual components of customer experience – success, effort, and emotion – and compared their results to the cross-industry average.

When we evaluated banks across these individual elements, we found that they:

- Surged ahead the most on effort. The average cross-industry effort rating in 2023 was 61%, which falls in the range of “good” scores. Banks received a score of 69%, rounding to a difference of 8 percentage points above this average. The highest-scoring bank earned an effort rating of 80%, while the lowest received a rating of 51%.

- Struggle to emotionally connect with customers. Overall, organizations performed most poorly on the emotion component of customer experience, with an “okay” cross-industry average rating of 50%. This was also banks’ lowest-performing component, with an average rating of 54%. A few organizations in the banking industry did achieve a “good” emotion rating, with the top-rated bank scoring a 67%.

- Enable customers to complete their tasks. The highest-rated component for both banks and cross-industry overall is success. Banks scored a rating of 70%, seven percentage points higher than the benchmark of 63%. The bank with the highest rating for this element received a rating of 83% (an “excellent” rating), while one bank had customers reporting a success rating of just 50%, landing them in the “okay” range.

Customer Service is the Most Problematic Journey

People often perceive the experiences they have with organizations at the journey level, evaluating their holistic experience while trying to achieve a specific goal. To understand the current state of key customer journeys, we asked 10,000 U.S. consumers to identify which industry-specific journeys organizations most needed to improve.

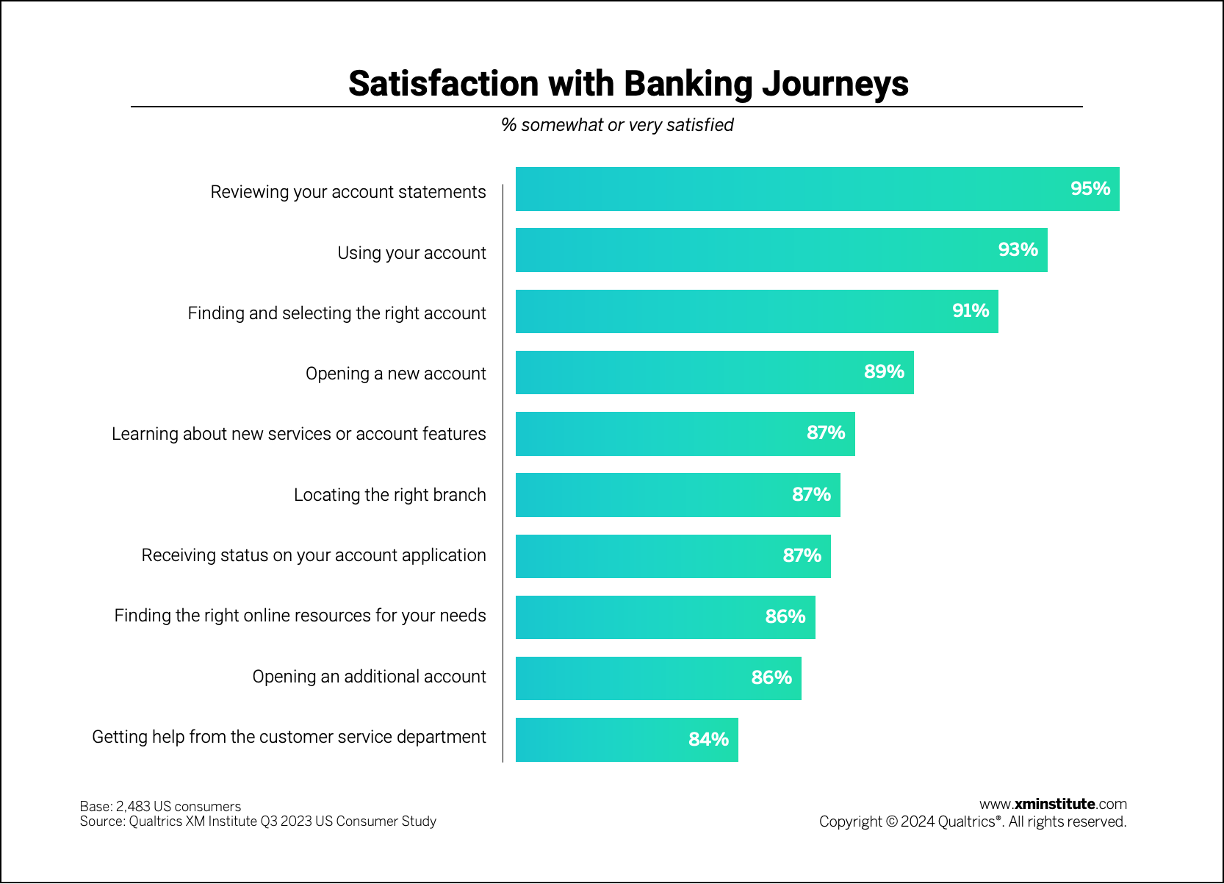

Respondents who recently had an interaction with a bank rated their satisfaction with ten common banking journeys on a five-point scale, and we captured the percentage of them who rated themselves as somewhat satisfied or very satisfied with each journey.

- Banking customer service requires the greatest improvements. Eighty-four percent of banking consumers say that they are satisfied with their experience getting help from the customer service department, the lowest satisfaction rate of all ten evaluated journeys, indicating that customer service falls short of customer expectations.

- Consumers are the most satisfied when engaging in more passive experiences. Passive experiences include reviewing account statements, using the account, and finding and selecting the right account. Between ninety-one and ninety-five percent of people were somewhat or very satisfied with those experiences, while just one to two percent of customers were dissatisfied.

Evaluating Digital Banking Experiences

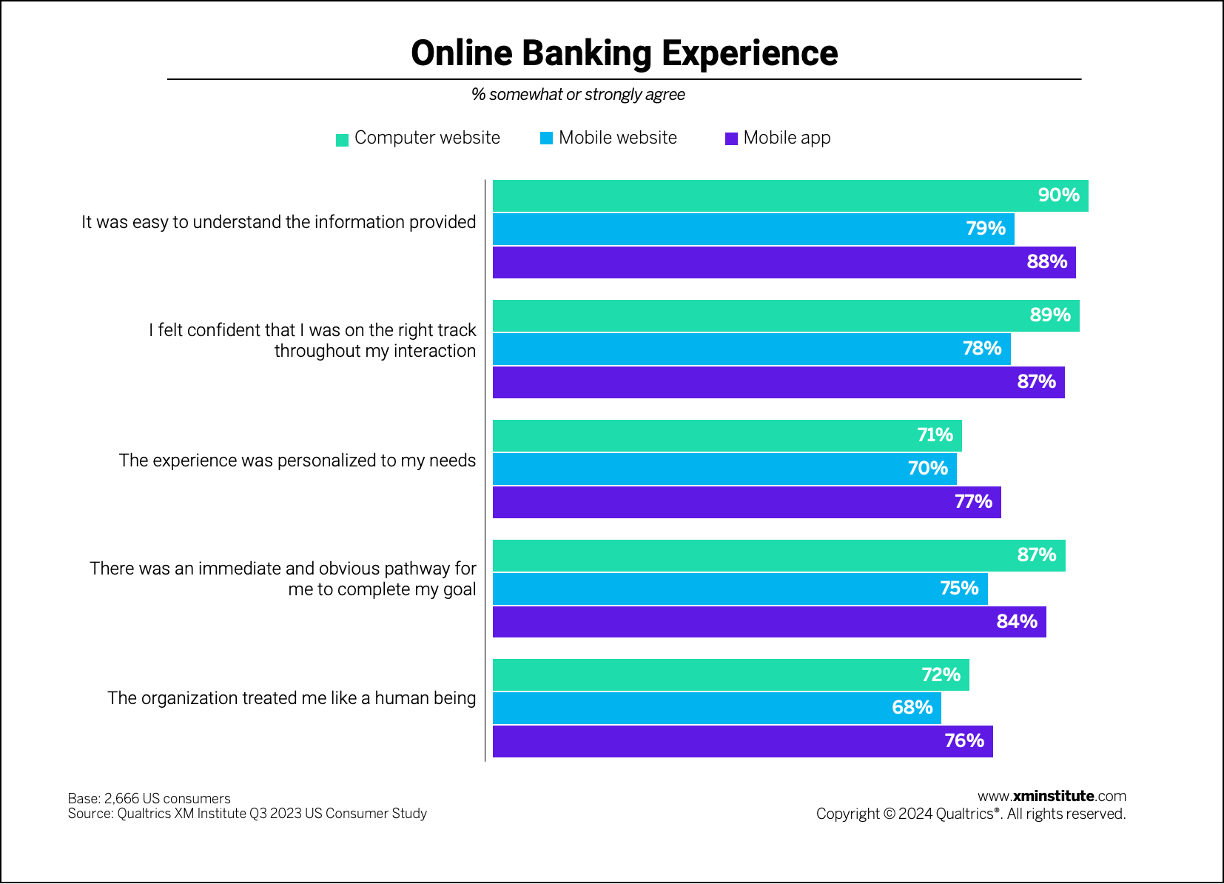

Digital channels have become essential to customer experiences in many industries, including banking. To understand how consumers evaluate the quality of the experiences delivered online, we also asked US respondents who had recently interacted with a bank through a computer website, mobile website, or mobile app to assess five dimensions of the experience.

The data shows that:

- Mobile websites produce the worst digital experiences. Across all five elements of the digital experience, banking mobile websites earned the lowest satisfaction scores.

- Personalization is problematic. On average across all three digital access methods, less than 73% of consumers agreed that the experience was personalized to meet [their] needs. Mobile apps far outpaced both mobile and computer websites for this element of a digital experience, with a rating of 77%, compared to 70% for mobile websites and 71%, for computer websites.

- Empathy in digital is difficult. Across the three access methods, the lowest proportions of consumers agreed that the organization treated me like a human being, with both computer websites (72%) and mobile web (68%) scoring lower than apps (76%).

Recommendations For Banks

Reflecting on these insights, there are a number of immediate opportunity areas for banks:

- Humanize digital experiences through personalization. Digitization of the retail banking industry is here to stay. Driven by customer preference for convenience in many routine transactions and the industry’s focus on cost control, investment in digital channels is accelerating. However, digital experiences today can be somewhat underwhelming. Across digital channels, bank customers report gaps in experience personalization and empathy. Not only does this frustrate customers, it can negatively impact business outcomes. In contrast, companies that lead the way in creating personalized experiences see huge benefits, including 40% more associated revenue growth, significantly reduced cost of customer acquisition, and a 10-30% increase in marketing ROI. Digital optimization allows organizations to create ‘know-me’ experiences at scale by combining operational, behavioral, and experiential data to reduce friction, optimize customer journeys, communicate more effectively, and design better products. A great place to start is by capturing zero-party data. Zero-party data includes the personal preferences, goals, and needs that a customer voluntarily shares with your bank, enabling you to deliver personalized content and recommendations based on their preferences. For example, one U.S. bank offers new customers a digital “Help Me Decide” tool, which asks customers a series of questions about their banking needs and then recommends the product best suited to them. Not only does this tool help the bank get a clearer picture of who exactly a customer is, but with nearly 250,000 possible ways to go through the questions, the resulting product suggestions are customized for each individual.

- Make your contact center a competitive differentiator. Compared to other journeys, bank customers have the lowest level of satisfaction with getting help from the customer service department. When we think about why customers call the contact center – they need help with a problem they can’t otherwise solve – this isn’t necessarily surprising. Journeys that begin digitally often end up in the contact center when they don’t go as planned. Contact centers often present the richest seam of data for analysis and action as well as a large cost item due to the labor-intensive nature of the work. By leveraging analytics software that allows the company to understand the conversations between the bank and the customer, and flag key conversation topics (complaints, suggestions, life changes) and emotion/effort/intent around those, banks can make the customer service experience a key competitive differentiator. When GM Financial did this, they were able to identify specific and actionable pain points in the customer journey. As a result, GM Financial fine-tuned digital channels to better serve customer needs, reduce call volume, and improve customer loyalty. At the same time, they improved employee experience by identifying what high-performing agents were doing to deliver the best customer experiences and scaling those behaviors across the organization.

- Create a comprehensive listening strategy across customer channels. Banks will often have listening programs that are channel-specific. Customers, however, are increasingly expecting their multi-modal journeys (e.g., begin on the app, speak with an agent on the phone, sign paperwork with a banker in the branch) to be continuous, with information and context carried over from one channel to the other. A comprehensive customer listening strategy, often referred to as omnichannel listening, helps solve this problem by creating a seamless customer experience across channels, simultaneously reducing over-reliance on the contact center and improving customer experience. Combining survey, digital, and call center data into a holistic view provides context for understanding consumer behavior and, ultimately, the drivers of business outcomes. With this rich understanding of customer experiences, banks are positioned to take action on feedback. Whether it’s understanding which digital experiences drive the most call volume or picking up a signal from the survey program that branch staff are less than knowledgeable in a product, leveraging omnichannel listening to shape the experience in every channel and every journey is increasingly the gold standard in Experience Management.

- Invest in building trust. While trust in the banking industry increased by 9 percentage points overall in the last decade, it dropped three points between 2022 and 2023, leaving room for improvement in the year ahead. As banks look to reclaim pre-pandemic highs in customer experience, trust is the currency that will set leading financial institutions apart. But it’s no secret that trust is harder to earn than it is to lose, so where should banks begin? One area that drives trust and is ripe for improvement is communication – customers identify finding online resources and getting updates on application status as poorly performing journeys, signaling room for improvement in how banks communicate. Given the wide customer use of websites and apps to find information, complete tasks, and solve problems in financial services, optimizing digital communication should be a priority. Customers need to be able to find clear information quickly, easily and reliably to build trust in their bank’s ability to deliver on its promises. Additionally, banks can build trust with streamlined and straightforward communication through chat and call center interactions. When customers engage chats and call center representatives, they need to be confident they are getting accurate and reliable information. With the recent advancement of Artificial Intelligence-powered tools capable of providing real-time guidance for customer service representatives, banks have an opportunity to solve customer problems faster and more effectively than ever before. At the end of the day, trust is about building a relationship, and the foundation of any strong relationship is clear and honest communication, which starts with providing easy-to-understand and transparent information to customers across all of your bank’s channels.

The bottom line: Banks that deliver customer-focused, personalized experiences across all of their channels will rise to the top.

Katie Johnson is a Financial Services Solution Consultant at Qualtrics

Talia Quaadgras is a Research Program Manager with the Qualtrics XM Institute.

Isabelle Zdatny, XMP, CCXP, is the Head of Thought Leadership and an XM Catalyst with the Qualtrics XM Institute