To understand how the quality of customers’ experiences varies across industries, XM Institute conducts annual large-scale U.S. consumer studies. As part of these studies, we ask respondents to rate their recent interactions with hundreds of organizations across more than 20 different industries. In this blog post, we examine the state of customer experience (CX) in the health insurance industry.

Health Insurers Deliver Subpar Experiences

To generate the XMI Customer Ratings – Overall average score for each industry, we asked respondents to evaluate their experiences with organizations over the previous 90 days.1 These questions – rated on a seven-point scale – covered the three components of an experience: success (were they able to accomplish their goals?), effort (how easy or difficult was it for them to accomplish their goals?), and emotion (how did the interaction make them feel?). To produce the XMI Customer Ratings – Overall scores for each of the organizations included in these studies, we average the scores for each of these three experience elements. We then calculate the XMI Customer Ratings – Overall for each industry by averaging the individual Ratings of the organizations within each industry.2

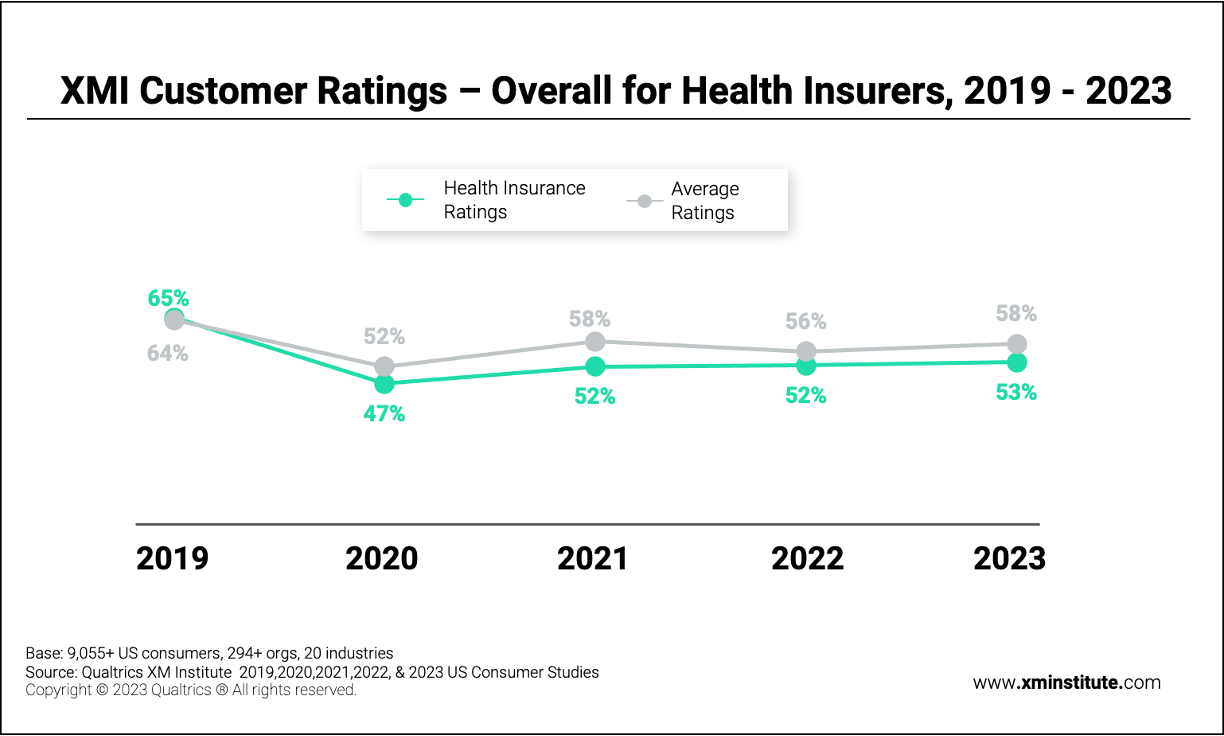

When we looked at how health insurers performed compared to other industries, we found that they have received slightly below-average XMI Customer Ratings – Overall scores over the past several years.

When it comes to overall customer experience performance, we found that health insurers:

- Received an average rating of 53%. In our 2023 U.S. Consumer Study, health insurers earned an average XMI Customer Rating – Overall score of 53% and came in 16th place out of the 20 industries included in this analysis.

- Consistently perform below average. Over the last few years, health insurers’ average ratings have remained relatively stable, only improving by six percentage points since 2020. In that same time period, health insurers have maintained a similar position in the rankings compared to their peers across industries. In 2020, they ranked 14th out of 20 industries. In 2021, they came in 17th place, and in 2022, they placed 12th out of 20 industries. In 2019, their strongest year, health insurers ranked 8th out of 20 industries.

- Have dropped since 2019. Since 2019 – a high watermark of health insurance CX performance – the average industry score for health insurers has dropped by 12 percentage points. Of the 20 industries we’ve included in the study every year for the past five years, 16 of them have seen their ratings average decline since 2019. Health insurers, however, have seen one of the most significant declines, with only five industries falling further.

Health Insurers Struggle with Effort and Emotion

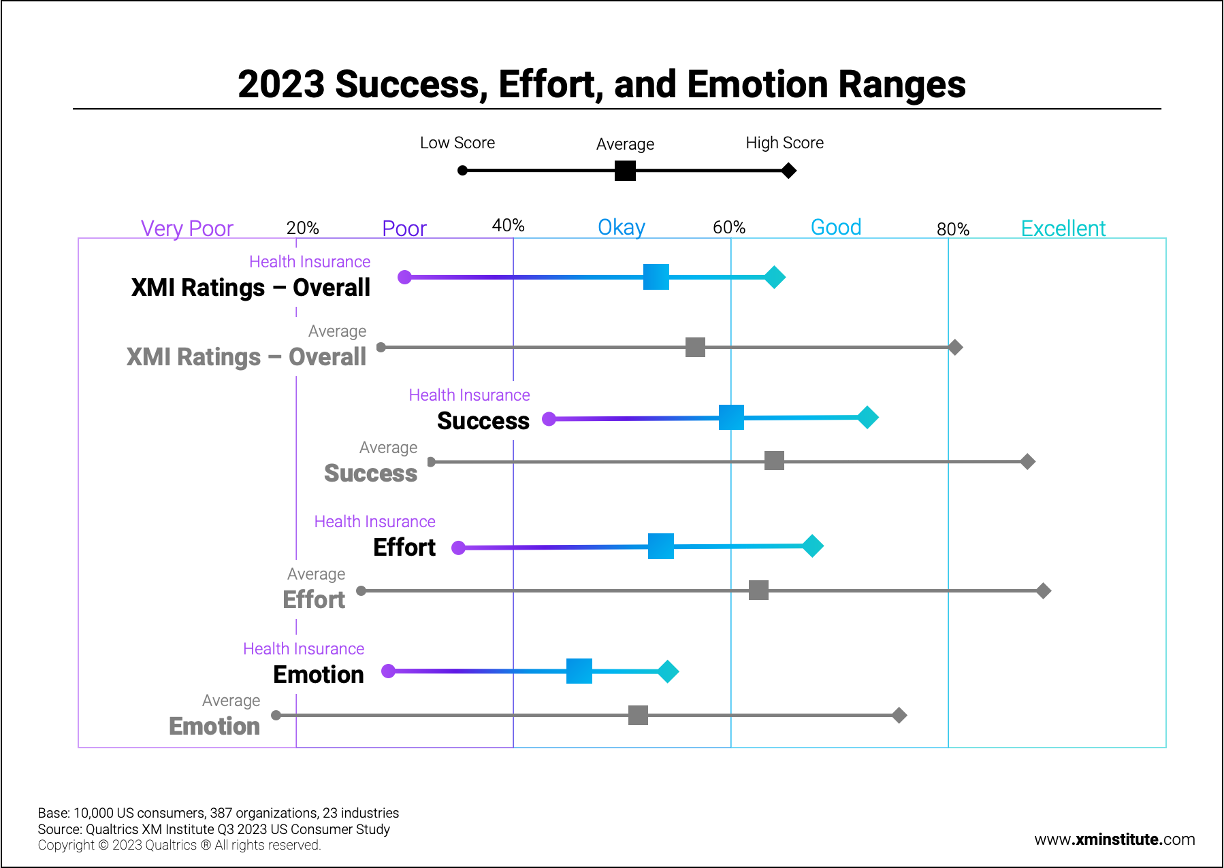

We also examined how health insurers performed in 2023 across each of the three individual components of customer experience – success, effort, and emotion – and compared their results to the cross-industry average.3

When we evaluated health insurers across these individual elements, we found that they:

- Fell furthest behind on effort. The average effort rating across industries in 2023 was 61%, which falls in the range of “good” scores. Health insurers, however, received an “okay” effort rating of 53%, eight percentage points lower than the average. The highest-scoring health insurer earned an effort rating of 66%, while the lowest received a score of 35%.

- Fail to emotionally connect with members. Overall, organizations performed most poorly on the emotion component of customer experience, with an “okay” cross-industry average score of 50%. This was also health insurers’ lowest-scoring component, with a 45% average rating. No organization in this industry even received a “good” rating in this category. The top-rated one scored 53%, and the bottom-rated one scored 27%.

- Mostly enable members to accomplish their goals. The highest-rated component for both health insurers and industries overall is success. Health insurers’ average score fell only three percentage points below the benchmark for this element – 60% compared to the cross-industry average of 63%. The health insurer with the highest rating in this category earned 72%, which qualifies as a “good” score, while the lowest received 42%, landing them in the “okay” range.

Claims Management is the Most Problematic Journey

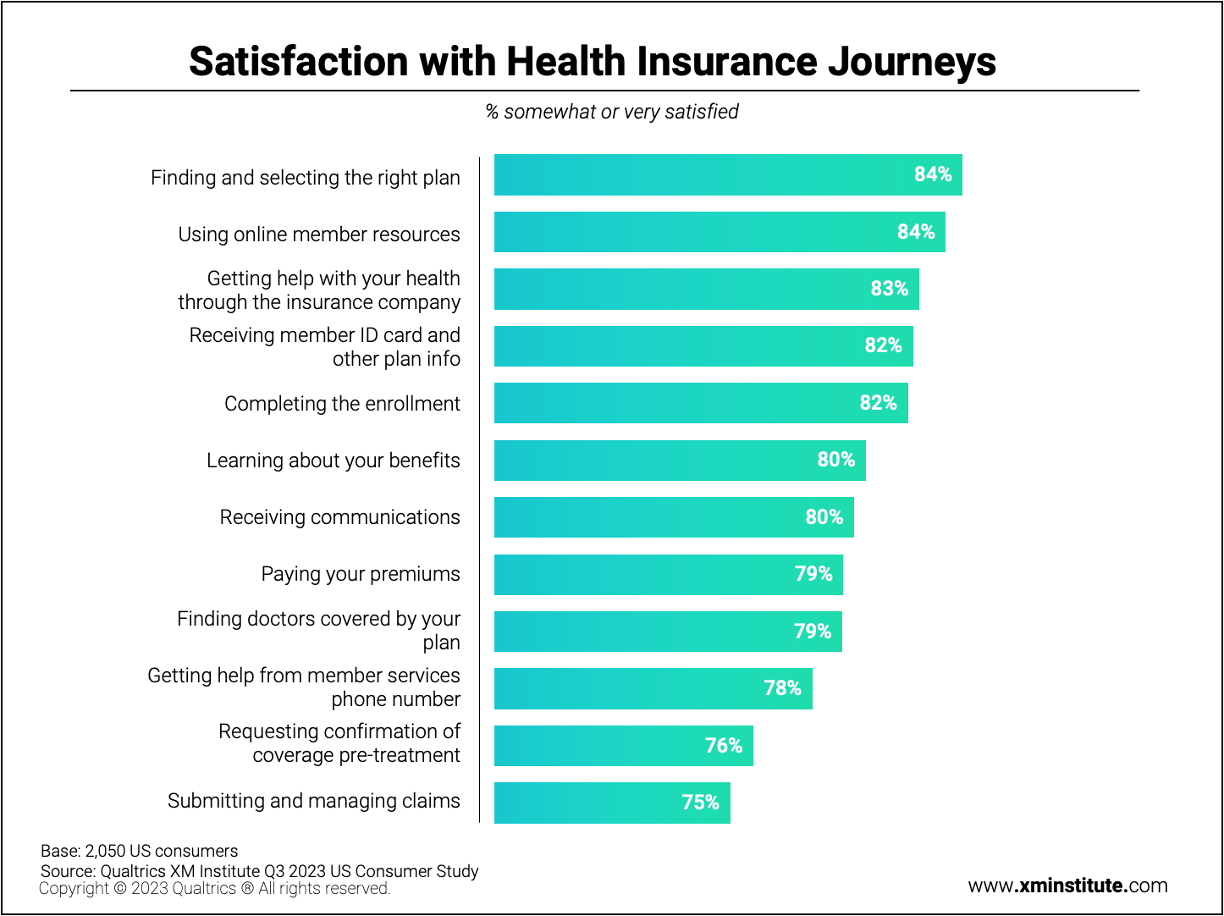

People often perceive the experiences they have with organizations at the journey level, evaluating their holistic experience trying to achieve a specific goal. So to understand the current state of key customer journeys, we asked 10,000 U.S. consumers to identify which industry-specific journeys organizations most needed to improve. Respondents who recently had an interaction with a health insurer rated their satisfaction with those common journeys on a five-point scale, and we captured the percentage of them who rated themselves as somewhat satisfied or very satisfied with each journey:4

From these results, we learned that:

- Members are least satisfied with claims management. Three-quarters of members report feeling satisfied with their experience submitting and managing [health insurance] claims, the lowest out of all 12 evaluated journeys.

- Confirming coverage pre-treatment also creates negative experiences. Just 76% of members express satisfaction with the process of requesting confirmation of coverage pre-treatment – likely due to its complexity and lack of transparency throughout much of this process.

- Health insurer customer service experience falls short of expectations. Members are also comparatively less satisfied with the journey of getting help from member services phone number, suggesting many contact center experiences fall short of member expectations, and that there is a need for improvement among the health insurance industry’s customer service.

Mobile Apps Facilitate the Best Digital Experiences

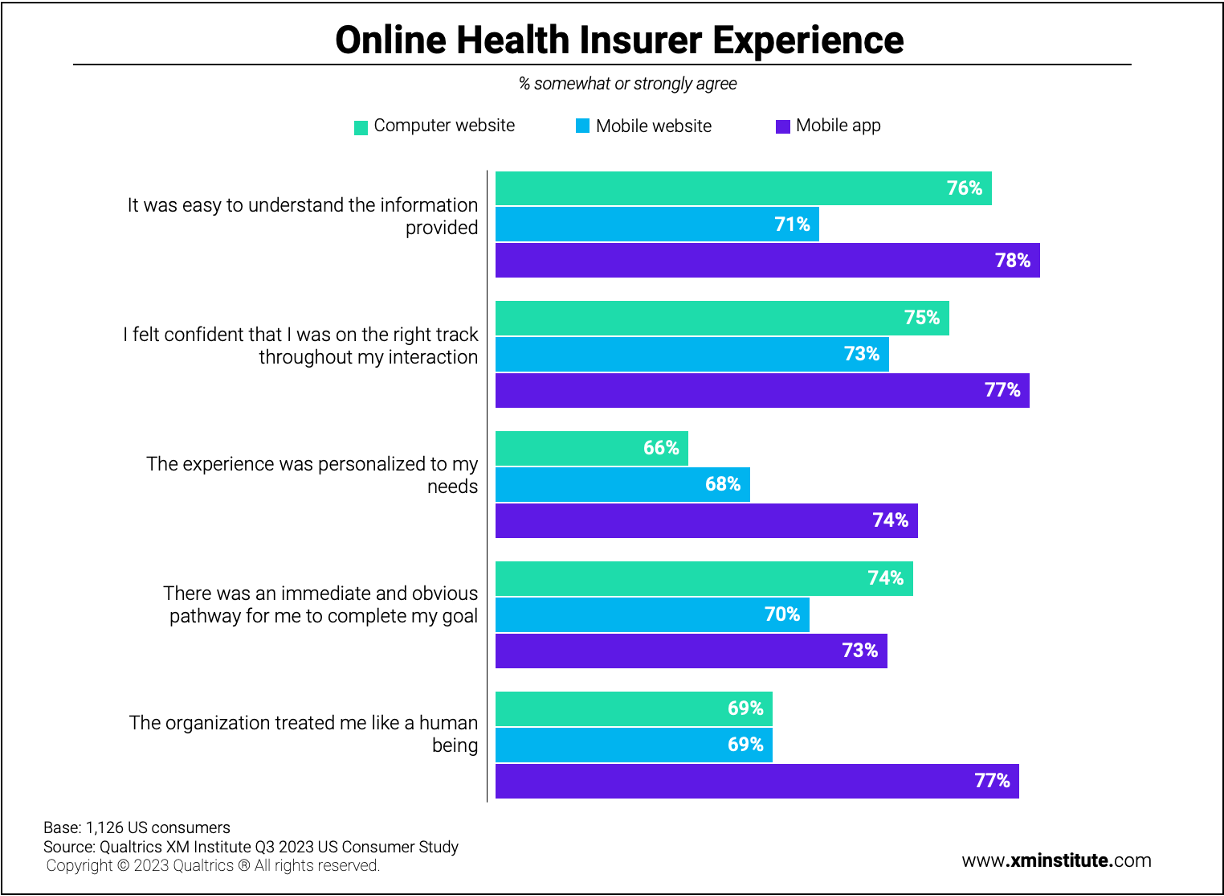

Digital channels have become the backbone of customer experiences for most industries, including health insurance. To understand the quality of the experiences delivered in these online environments, we also asked US respondents who had recently interacted with a health insurer through digital channels to assess five dimensions of their experience. We then analyzed the data based on whether members engaged with the organization through a computer website, mobile website, or mobile app.5

This data shows that:

- Mobile websites produce the worst digital experiences. Health insurer’s mobile websites earned the lowest satisfaction scores across almost every element we evaluated. The only exception was the experience was personalized to my needs, where computer websites received the lowest score.

- Personalization needs work. Of the five elements we looked at, the experience was personalized to my needs scored the lowest, with an average of 69% of consumers who agree with this statement. At the other end of the spectrum, 75% of consumers felt that it was easy to understand the information provided. For both elements, the mobile app experience outperformed computer and mobile websites.

- Health insurers’ mobile apps facilitate human connection. Of the five elements, the organization treated me like a human being has the largest gap between the three digital channels. While only 69% of respondents felt this while engaging with health insurers through computer or mobile websites, 77% agreed with this statement after using a health insurer’s mobile app.

How to Advance Your Member Experience Program to the Next Level

Improving customer experience in the healthcare industry presents some unique challenges. Not only is it a complicated and highly regulated environment, but because most health insurers have traditionally focused on employer-driven models, which limit customer choice, their culture and processes are often not as customer-centric as other industries. To advance their CX efforts, health insurers should invest in maturing their capabilities across the three elements of the XM Operating Framework: Technology, Culture, and Competency. Ultimately, any health insurer looking to differentiate itself based on its member experience should aim to build what XM Institute calls a “Modern XM Program.”

Here are some recommendations for how health insurers can create a modern member experience program:

- Build individual profiles for each member. Historically, health insurers have operated in a fragmented data environment, where member data from different sources would be housed in siloed business systems owned by separate teams. This disjointed view of individual members often resulted in complicated, impersonal customer experiences – hence the comparatively low scores for effort and personalization. Today, leading health insurers are connecting all their member experience data together in a single, easily accessible pool that is organized around individual members. These member profiles pull in structured and unstructured data from a variety of different sources, including account data (e.g., health insurance plan, demographic information, claims history), experience data (e.g., survey scores, open-end verbatims, online reviews), real-time behavioral data (e.g., interaction history, real-time digital behaviors, billing habits), preference data (e.g., health goals, preferred communication channels, personal traits), as well as data pulled from integrations like CDP, CRM, and web analytics platforms. Building such profiles allows health insurers to develop a comprehensive, omnichannel view of members that they can use to personalize people’s experiences based on a nuanced understanding of their individual context. These profiles also enable organizations to create dynamic member segments and then develop new service and product offerings that resonate with those key segments.

- Organize around member journeys, not functions. Another way leading health insurers are breaking down existing data and operational siloes is by aligning their internal structures around member journeys, not functional areas. For example, one health insurer – Neighborhood Health Plan of Rhode Island – reoriented its member experience efforts around key journeys, including the Medicaid member journey, Provider journey, and Exchange member journey. Its CX team started by working cross-functionally to create maps of these journeys, which it then used to build strategic alignment, define a consistent brand experience, refine listening architecture, and engage employees. It then operationalized these journeys by creating journey-centric governance structures made up of stakeholders from across the organization who are responsible for reviewing and improving experiences at the journey level. This journey lens has enabled the health insurer to create smoother, more integrative experiences for its members, regardless of the channel or functional area they use to interact with the company. If you are unsure which journey to tackle first, we recommend looking at either the most broken journey (claims management) or the customer service experience, which often has the most significant impact on member perceptions.

- Foster partnerships between contact center and digital teams. Leading health insurers are encouraging more collaboration between their digital and contact center teams, particularly when it comes to digital containment. These companies realize that, when these groups work together to drive digital self-service adoption, they can reduce their customer support call volume. This not only saves the company money, it enhances both member experience – as they are able to achieve their goals more quickly and easily – and employee experience, reducing the burden on contact center agents and freeing them up to help members with more complex, high-stakes issues. Health insurers are facilitating these cross-team connections by applying omnichannel analytics to data from these interactions. They are then able to surface and share top self-service opportunities the digital team can capitalize on.

- Use AI-powered technologies to improve efficiency. An increasing number of health insurers are applying advanced AI technologies to accelerate and automate their CX capabilities. For example, Generative AI can extract and summarize information from both structured and unstructured data sources, allowing organizations to automate call summaries and provide real-time assistance to agents. It can also recognize patterns across large data sets – resulting in more robust predictive analytics models – and interface with members in a way that mimics human conversations, which can power front-end chatbots to help divert volume away from the contact center. Additionally, AI solutions can personalize member experiences by tailoring information and tone of content based on an individual’s needs and current situation, as well as improve employee experiences by reducing the number of manual, repetitive tasks they are asked to do.

- Proactively address member experience gaps to improve Star ratings. One of the benchmarks members use to compare the quality of different health insurance plans is the five-point star ratings released by healthcare.gov, which assesses health plans across three attributes: member experience, medical care, and plan administration. Traditionally, health insurers have attempted to improve their Star ratings primarily by conducting a mock-CAHPS survey to a random selection of members. These surveys tend to be challenging to act on, and even if critical experience issues are identified, they typically go unresolved for weeks or months. Leaders in this space, however, recognize that this approach is no longer sufficient. Instead, they create an early warning system that leverages data from all member experience channels to proactively uncover and improve underperforming areas before the official CAHPS survey administration period.

The bottom line: Health insurers have an opportunity to differentiate themselves in the market by systematically improving the experiences they deliver to members.

Noah Gilbertson is a Solution Strategist at Qualtrics who specializes in Healthcare.

Talia Quaadgras is a Research Program Manager with the Qualtrics XM Institute.

Isabelle Zdatny, XMP, CCXP, is the Head of Thought Leadership and an XM Catalyst with the Qualtrics XM Institute

- The full XMI Customer Ratings – Overall benchmarks from 2019-2023 are available in the Benchmark Editor to CX customers on the Qualtrics platform.

- The 2019-2023 cross-industry XMI Customer Ratings – Overall are calculated by averaging the success, effort, and emotion scores across only the 20 industries for which we have data for all years 2019-2023.

- The cross-industry XMI Customer Ratings – Overall and success, effort, and emotion scores and ranges include the full 23 industries surveyed and evaluated in the 2023 benchmark.

- Satisfaction with Health Insurance Journeys was developed by screening for respondents that had each health insurance experience within the past 30 days and asking them to rate their satisfaction on a 5-point scale of very unsatisfied to very satisfied. The number of selecting very and somewhat satisfied each experience was then divided by the total number of respondents that had each respective experience.

- Online Health Insurer Experience was developed by screening for respondents that had an experience with a health insurer within the past 30 days and asking which method they used to interact with the health insurer online. They were then asked to respond on a 5-point scale of strongly disagree – strongly agree to each of five statements about that online experience. The percentage that strongly and somewhat agree is shown.