Net Promoter® Score (NPS®) is such a popular yet misunderstood topic that I tend to write a post about it every year. Even though my advice hasn’t changed much since I wrote “Net Promoter and Satisfaction Battle for King of the Ring” over 13 years ago, companies continue to be overly enamored by the potential for a quick fix from this metric, which was originally introduced as The Ultimate Question. Let me make a clear point: NPS is not a quick fix, nor is it the ultimate question.

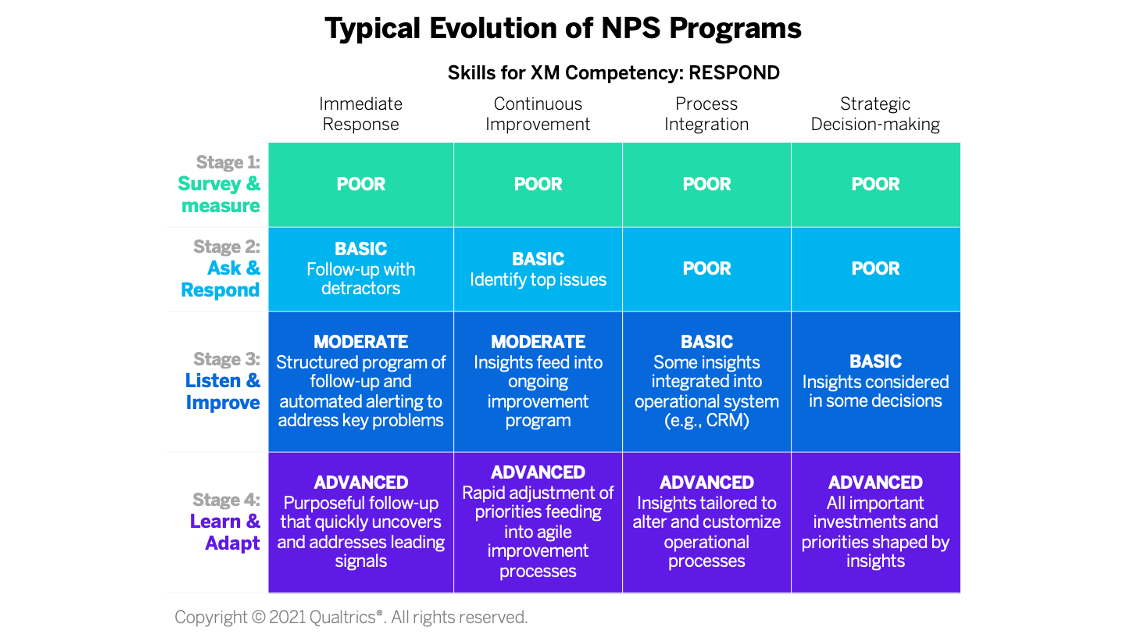

Four Stages of NPS Progression

While many organizations use NPS, they’re only successful when it’s deployed as part of an overall system that’s focused on driving action. To get a sense of the different deployment approaches, I’ve defined these four stages of NPS which are prototypical of what I’ve seen across the many companies that I’ve worked with:

- Survey & Report. Buying into some of the simplistic hype about NPS, organizations often start asking the NPS question without making any significant changes to their operational processes. They report the score, start setting targets, and spend a lot of time debating the data and being confused about why the number is moving up or down. They sometimes get so excited about the metric that they inappropriately use it as a measurement for many of their customer interactions. If organizations stay in this stage, their NPS programs either fail or continue to operate with little impact.

- Ask & Respond. As organizations get a feel for NPS, they will often develop a closed-loop process of following up with respondents. It generally starts with reaching out to detractors, but more mature efforts include promoters and passives as well. This pushes the team to incorporate some operational data in order to better understand the people they’re contacting and to improve their issue tracking and escalation processes. When done well, closing the loop provides a natural flow of customer insights that drives organic improvements and even some culture change.

- Listen & Improve. Organizations that continue on the NPS path build the capability to understand what drives people to become promoters and detractors. This requires a cohesive connection between NPS and other elements of experience data, from customer interactions and journeys. They also increasingly incorporate operational data to better understand the specific drivers for individual customer segments. In the best cases, this effort is connected to a strong continuous improvement program.

- Learn & Adapt. In this advanced stage, NPS is not an independent program but integrated as a key element of what we’ve called Modern XM. NPS is used to drive the ongoing process of discovery that uncovers leading signals of shifts across customer segments and operating units. In these types of companies, NPS-related insights are tailored to drive real-time adjustments of operational processes and are a part of most strategic decisions. Very few firms have reached this level.

Driving Action with NPS

Ultimately, the success of any NPS program is tied to the better decisions that it enables and the interactions that it improves. Without those results, NPS provides no more than a diversion with a number. How should you think about driving action with your NPS program? By mastering the XM Operating Framework, starting with a focus on these four skills associated with the RESPOND competency:

- Immediate Response. Any successful XM effort must include the capability to systematically follow up with people who are affected by an experience – as indicated by their feedback or discovered through analytics – and fix the problems that are uncovered. To master this skill, companies should automate and manage a closed-loop process using tools such as ticket management, status updating, and tracking.

- Continuous Improvement. Organizations need to make ongoing changes to operational processes based on a continuous flow of X- and O-data insights. This skill often includes a well-defined process for diagnosing and prioritizing potential areas of improvement depending on how they would impact experiences and business results.

- Process Integration. In addition to making decisions based on insights, organizations should infuse those insights into key operating processes and systems. For instance, organizations should use employee feedback to tailor the curriculum and content of their leadership development program.

- Strategic Decision-Making. An organization’s most important decisions can tap into insights from X- and O-data. Everything from new product investments to mergers and acquisitions should be informed by XM program insights.

This chart demonstrates how organizations typically fare in each of those skills across the evolution of NPS programs.

Recommendations for Evolving Your NPS Program

Here are some recommendations on how you can build those RESPOND skills and propel your NPS programs to a higher stage:

- Obsess about the two ultimate questions. While NPS is not the ultimate question, there are two questions that should be on the lips of every executive: What have you learned? What improvements are you making? This focus on action will keep the organization from falling into the natural trap of overly obsessing about the data.

- Reverse direction and focus on data last. As you can see above, NPS programs often start focusing on the data. However, that’s not what creates value. Instead, start by defining a set of actions you plan to take or the decisions you want to support and use that information as the requirements for the rest of the program. Consider using fake reports to guide your data needs.

- Use NPS to understand attitudes, not perceptions. The likelihood that someone will recommend a company does not provide clear feedback about an individual interaction such as the success of a contact center call or the usefulness of an online article, no matter how you reconfigure the question. That’s because NPS is a measure of people’s relationship attitudes, not their perceptions. It’s a reflection of a person’s view across multiple interactions. The best use of NPS is as a relationship tracking mechanism, so think about where you use—and don’t use—it.

- Examine detractors and promoters separately. The most important thing you can do with NPS is to understand and act on the underlying factors driving NPS. The things that create promoters are not just the opposite side of the issues that create detractors. So you need to separately identify changes that will increase promoters and decrease detractors. Companies often start by focusing just on detractors. This helps to fix problems, but it does not identify opportunities to propel your organization.

- Look for insights for key customer segments. Identify one or two key customer segments and focus on the question, what makes them promoters or detractors? Answering this question for individual groups of customers pushes you to incorporate some of the critical operational data and to establish a strong insights framework.

- Sample very, very deliberately. If you have multiple segments of customers with different NPS profiles (as many do), then your overall NPS can change wildly based on the mix of those customers that are included in any NPS calculation. So you need to be very clear on how you mix those groups in your analysis and reported metrics. In B2B, this may mean separating results from enterprise accounts and smaller clients, and being clear on how to mix responses for individual accounts across personas such as executive decision-makers and end-users.

- Don’t over-compensate. When an organization shares a common metric (like NPS) and its people collectively have some compensation tied to it, then it can help align everyone’s focus on customer experience. But if the compensation gets too significant, then people start focusing too much on the number—questioning its validity and strong-arming customers—instead of looking for ways to make improvements. Keep compensation focused on NPS scores as an organizational alignment mechanism, not as a blunt instrument for driving behavioral change of individual employees.

- Set goals as ranges, not numbers. NPS is an inherently jittery metric; there’s only a porous line keeping passives from becoming promoters or detractors. And as I mentioned earlier, uncontrolled sampling patterns can drive changes in the score that don’t match actual changes in customer attitudes. Instead of setting NPS goals as a specific number, consider defining a range (similar to a process control chart). As a start, think about adopting a 3- to 5-point range. That way you only react to results outside of the range or consecutive periods of increases or declines.

- Consider relative measurements. Is a promoter who gives you a 9 loyal? Does your thinking change if they give your competitor a 10? What about if they give your competitor a 3? If you’re looking to try something new, consider looking into a relative metric that examines how individuals view your organization when compared with their alternative choices.

The bottom line: Don’t waste your time with an action-less NPS program.

Bruce Temkin, XMP, CCXP, is the Head of Qualtrics XM Institute

Note: Net Promoter, Net Promoter Score, and NPS are registered trademarks of Bain & Company, Inc., Fred Reichheld, and Satmetrix Systems, Inc.