XM Institute is happy to announce that we are launching a new economic indicator, Business Resilience Index (BRI), that tracks the human-side of businesses by examining how people feel about the companies they interact with, as prospects, customers, and employees. We believe that this index will become a valuable mechanism for exposing important societal-level shifts in the relationships between people and organizations.

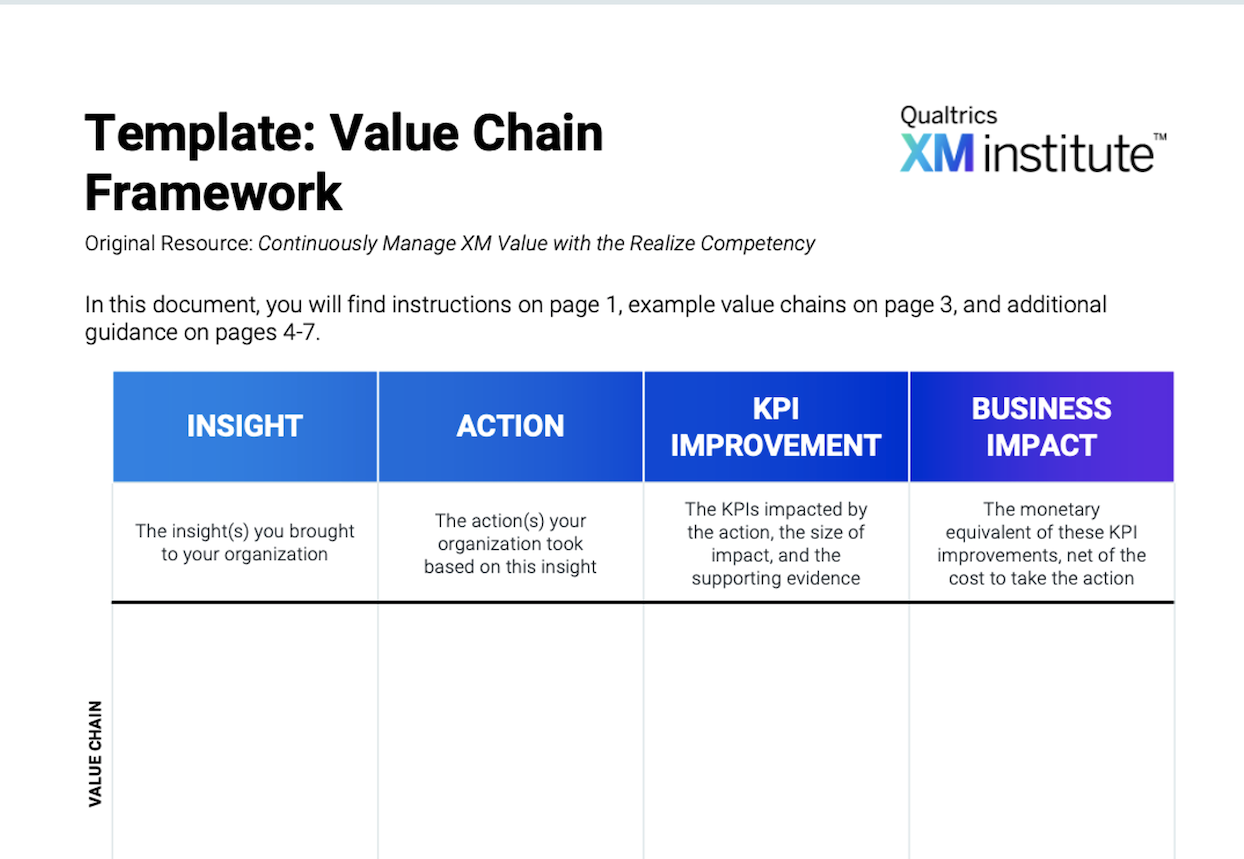

The BRI is built around measuring customer experience, brand experience, product experience, and employee experience. For each of those areas we ask consumers to rate three fundamental elements for each of those experiences (see the methodology section at the end of the post).

Results from Q3 2022 Business Resilience Index

We recently published the Q3 2022 Business Resilience Report, showing that the overall BRI for the U.S. is 75%, as you can see in the graphic below from the report. Here are some high-level insights from our analysis of this initial BRI:

- Customer experience (CX) is 79%. For the three elements of CX that we track, success and effort were both above 80%, but the emotion component was far below, at 65%. When we examined the CX data across 20 industries, grocery stores, retailers, hotels, and fast food restaurants were at the top, while auto dealerships, health insurers, and airlines were at the bottom.

- Product experience (PX) is 78%. One of the elements of PX, useful, was the highest rated element across the entire index, reaching 90%. The reliable element of PX drops off to 82%, and the innovative element falls way below at 63%. When we examined the PX data across 20 industries, computer/tablet makers, software companies, and electronics makers were at the top, while fast food restaurants, rental car companies, airlines, and insurers were at the bottom.

- Employee experience (EX) is 72%. For the three elements of EX that we track, accomplishment came out on top at 79%, followed by recommend at 73%, and motivated ended up with the lowest EX score of 64%. When we examined the EX data by age groups, we found that the employees with the lowest scores (68%) were between 45- and 64-years old. We also found that senior leaders (85%) had higher EX scores than managers (76%) and individual contributors (66%). We also looked at a number of different job types and found that trades, factory, and construction workers had an EX score 10 percentage-points higher than the U.S. average, while front-line workers in hospitality, food service, and retail were 6 percentage-points below the average.

- Brand experience (BX) is 68%. One of the elements of BX, values, is the lowest rated element across the entire index, reaching only 52%. The trust and appeal elements were much higher, at 77% and 74% respectively. When we examined the BX data across 20 industries, software and investment firms earned the highest ratings, while utilities and rental car companies earned the lowest scores.

Human Experiences Impact Business Results

XM Institute has published a lot of research that shows the ROI of improving human experiences. This connection between better experience and business results shows through in the BRI as well. We found that higher BRI scores lead to:

- 2.3 times more likely to repurchase. We combined the CX, BX, and PX ratings and compared the loyalty of respondents who were in the top quartile with those who had scores in the bottom quartile. Eighty-seven percent of the people with higher ratings are likely to buy more from the companies they do business with, compared with 38% of those with the lowest ratings.

- 3.0 times more likely to recommend. We performed the same analysis with the CX, BX, and PX ratings for the likelihood to recommend a company to friends and relatives. 91% of the people with higher ratings are likely to recommend the companies they do business with, compared with 30% of those with the lowest ratings.

- 39% less likely to leave their jobs. We compared respondents who were in the top quartile of EX ratings with those who had scores in the bottom quartile. 20% of the people with higher ratings are likely to look for a new job over the next six months, compared with 33% of those with the lowest ratings.

Commentary on the Q3 2022 Results

Since this is the first time that we are publishing the BRI, we do not yet have any trends to identify. However, here are some questions we have after reviewing the Q3 2022 results:

- Will investment firms stay strong in a challenging market? Investment firms are tied for the highest combined CX, PX, and BX scores, with their biggest lift from being 10 %-points above the average for BX. They earned the highest overall trust and appeal ratings. It will be interesting to see how consumers view their investment experiences if the stock market continues to decline.

- Will the auto market turn around when supply improves? Auto dealers are tied for the lowest combined scores. Their lowest relative scores are in CX, with the biggest problem area being their success ratings. Consumers can’t get the cars or the service that they want. We will watch how these relationships evolve as the inventory of cars changes.

- Will summer travel push airlines lower? Airlines are the other industry tied for the lowest overall combined scores, with similarly below average across CX, BX, and PX. The industry lags largely due to its scores for ease in CX and reliability in BX. Given the problems with flight cancellations and delays, the heavy summer travel season may be a problem for airlines.

- Can marketing improve utilities? Utilities are above or at average on five out of the nine sub-elements of the ratings, but drop down in the overall ratings because of a few key areas: emotion in CX, innovative in PX, and appeal in BX. There might be an interesting marketing opportunity across the industry.

- Will front line employees get more motivated? We found the lowest EX ratings (66%) with hospitality, food service, or retail (front-line workers), and with individual contributors (68%). Their low scores were mostly driven by the motivated element, so we’ll want to see if this is a persistent situation or something temporary.

- What’s up with the careers of 45- to 64-year-olds? This group of employees have by far the lowest EX scores, and fall to the bottom across all three EX elements. We’ll continue to track this situation and dig deeper into it if it remains a persistent theme.

- Will more organizations start to meet the expectations of Gen Z? People in this age group gave companies the lowest scores in every experience area of the BRI. We’ll be keeping an eye out to see whether that changes over time.

BRI Methodology

The Business Resilience Index is made up of four experience areas: Employee Experience (EX), Customer Experience (CX), Product Experience (PX), and Brand Experience (BX). For each of these experience areas, survey respondents were asked the degree to which they agree or disagree with these component statements:

To generate scores for each of these components, we divided the number of respondents that said they “agree” or “strongly agree” with the statement by the total number of respondents. To generate each experience area score, we calculated the average of the three component scores. We then generated an overall Business Resilience Index score by averaging all four experience area scores together.

To understand the return on investment of having high-scoring experiences, we created a composite score for each industry response of all CX, PX, and BX components, then found the 25th and 75th percentile of those scores. We then calculated the percent of responses likely to recommend and purchase more with CX/PX/BX scores below the lowest quartile and above the top quartile. We also created a composite score across the EX components and found the 25th and 75th percentile of that score, then calculated the percent of respondents likely to look for a new job in the immediate future with scores below the lowest quartile and above the 75th quartile.

The bottom line: Organizational resilience requires strong human connections.

Bruce Temkin, XMP, CCXP, is the Head of Qualtrics XM Institute

Moira Dorsey, XMP is a Principal XM Catalyst with the Qualtrics XM Institute

Talia Quaadgras is a Senior Research Associate with Qualtrics XM Institute