The X-data metrics we collect throughout an ecosystem can be invaluable for decision-makers who devise and execute strategies in competitive marketplaces. However, many organizations face a significant obstacle:

- Traditional metrics are customer-focused . . . Most organizations rely on X-data metrics (such as CSAT and NPS) to understand operational effectiveness and customer sentiment. These are known as “absolute” metrics and are reported in the usual ways, such as averages and percentage buckets (e.g. top-box).

- . . . but they’re not customer-centric. Reliance on absolute metrics and measuring performances of only your brand in isolation leaves you blind to the competitors and substitutes your customers consider (or maybe even use). The remedy for this myopia? Deploying these same metrics differently using a new type of understanding: relative metrics.

Why Are Relative Metrics Valuable?

Collecting relative metrics (also known as comparative metrics) can be done with very slight adjustments to modern X-data systems you already have in place. For example, if you’re collecting a single overall customer satisfaction metric in your ongoing relationship study, start collecting scores for other brands that customers actively use in the same category. By converting the data you gather from those ratings into rankings, you’ll have relative metrics which:

- Provide insight into how customers truly see your brand. Customers view your firm as one among a variety of options for solving a need. Each option competes and performs differently. That affects how customers perceive their experiences with each brand and, in turn, how they choose to spend their money among them.

- Impact how you gauge marketplace performance. Instead of knowing just NPS for your organization, you will also know what percentage of customers view you as “the best” as well as what percentage of customers have needs served beyond just the ones your firm provides. This change in perspective can have a material impact on decisions. When relative metrics are included in X-data, executives get insight into customers’ point of view and see that their organization may be performing well, but not necessarily in a differentiated way.

Relative Metrics Are Essential to Customer-Centric Strategy

Strategy can be highly nuanced, but it is easily distilled into 2 objectives:

- Tell me where to win, and how. What unique experiences can your organization provide? When your experiences aren’t unique to just your company, how do you do them better than competitors?

- Tell me how to do more with less. How can we simplify the experiences we provide, with fewer moving parts, at greater scale, without degrading the overall experience whatsoever?

Operating on both vectors requires companies to understand their competitive landscape and their place within it. Firms cannot execute an effective customer-centric strategy on absolute metrics alone; this is the root cause for the general lack of differentiation across markets. Customer-centric strategy requires the use of relative metrics.

By combining absolute and relative metrics, not only are advanced analytics improved, two simple models are made available which aid strategic direction and investment consideration.

Overall: Performance versus Competitive Differentiation

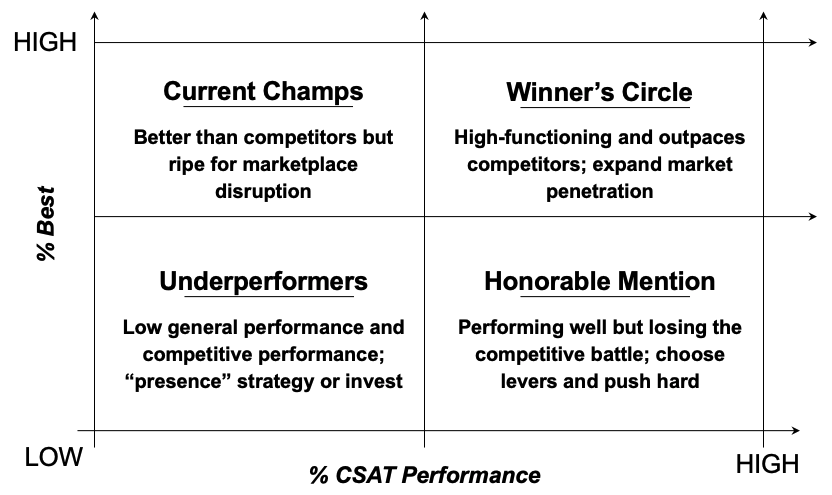

The first model for achieving greater effectiveness is simply remapping the overall X-data metrics into a new quadrant. This map juxtaposes the firm’s performance on traditional absolute metrics (e.g. CSAT and NPS) and how this relates to performance on a relative metric (e.g. % best).

Looking at absolute and relative metrics simultaneously is frequently a disruptive view of where a company stands, where time and resources should be focused, as well as the messaging that must be carried. Often, the mere recognition of where a firm truly stands can change leaders’ intentions, next-actions, and level of urgency.

Drivers: Performance Differentiation versus Behavioral Drivers

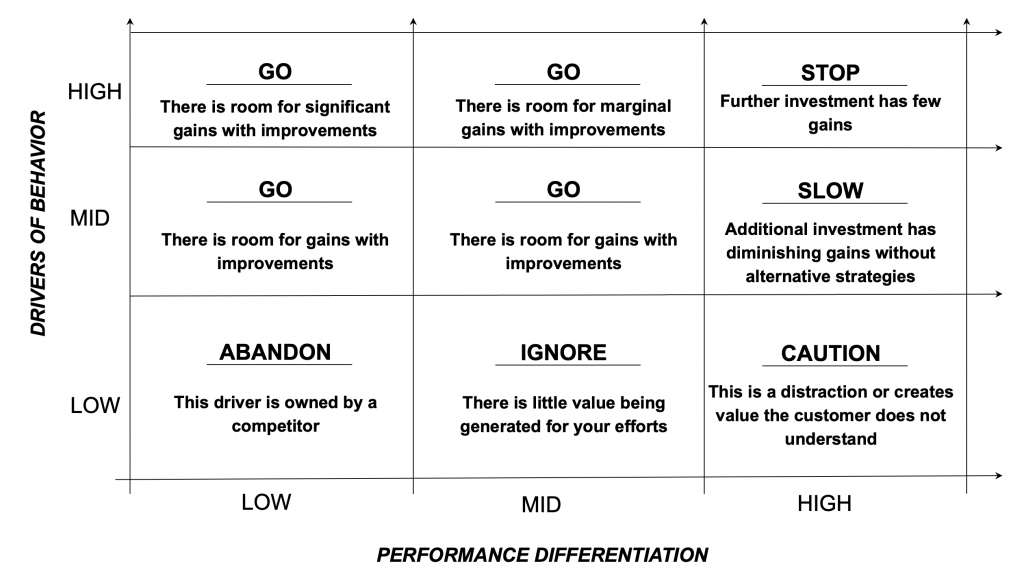

The second model for improving strategic outcomes with relative metrics is understanding that drivers of customer behavior and drivers of overall performance (and differentiation thereupon) are often different. Oftentimes, drivers of behaviors are based on primary category needs while sentiment is generally based on how well you deliver on expectations for the use case (assuming the firm addresses those category needs).

Compare this to a classical understanding of performance drivers where investments are traditionally made in low-performing places. Changing this definition to “low relative to competition” could reveal mislaid investments with indeterminate ROI.

The switch from a customer-focused strategy to a customer-centric one for many firms is technically simple but can unveil managerial challenges like these. Willingness to fully invest in the idea of customer-centricity brings sharp clarity to addressable gaps in experience delivery and financial performance.

Relative Metrics Change Priorities

The application of relative metrics can have myriad effects on a firm’s leadership, what they can glean from the X-data metrics, and how they approach strategic challenges in meaningfully different ways.

- Surviving In-Place. The most common takeaway for executives using relative metrics is this: “we’re doing well but there is more work to do if our goal is to be our customers preferred brand and win greater market share.” Strategies that are not customer-centric will not thrive.

- Diminishing Differentiation. Even when performing very well, it turns out that our competitors also perform very well (as poor performers always die off). But many remaining competitors often compete similarly, degrading the level of differentiation. To avoid tapering growth, firms need to further differentiate to avoid making excellent improvements that go unrewarded.

- “Our” Customers. Most importantly, leadership must accept that “our customers” is a fragile concept. In order to claim a customer as “our loyal customer,” a firm must become the preferred provider regardless of who else the customer may consider.

The bottom line: Relative metrics are the key to a more customer-centric view of markets and strategy.

Luke Williams is an XM Catalyst with the Qualtrics XM Institute