There was a thought-provoking article on BusinessWeek.com called ‘Meets Expectations’: The New ‘Exceeds Expectations’ which discusses research from the Corporate Executive Board. Here’s a key excerpt:

However, new research from the Financial Services Practice of The Corporate Executive Board finds that the pursuit of customer delight can actually negatively affect profitability and have diminishing loyalty returns. The key takeaway? Financial institutions that meet rather than exceed customer expectations maintain a profitability advantage of four percentage points.

My take: Since I did not conduct this research or see any of the analysis, it’s hard to discuss the findings. But I do want to discuss the implications.

First of all, it’s clear that within most normal ranges of activity, improved customer experience correlates to higher loyalty. And this is especially true in banking.

But even if “meeting” expectations may be appropriate, it doesn’t make sense to aim at just meeting customer expectations. That’s like a baseball player setting his sights on becoming a mediocre hitter. Companies that regularly meet customer expectations generally have a culture and a corporate desire to exceed customer expectations. So you need to separate the results from the desire. If you aim to be mediocre, you’re likely to end-up being sub-par.

This reminds me of a quote from Colin Powell: “If you are going to achieve excellence in big things, you develop the habit in little matters. Excellence is not an exception, it is a prevailing attitude.”

But I absolutely agree that no company, financial services or otherwise, should try and make every interaction a memorable, delightful experience. Companies need to understand that different interactions have different impacts on different segments of customers. So the first place to invest is in improving the “moments of truth” for key segments.

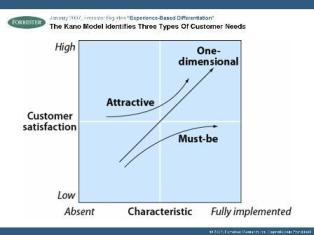

And when you think about how to invest in customer expectations, the Kano Model does a good job of framing what you need. Make sure you have all of the “must-be” attributes, dial up the “one-dimensional” attributes to meet your goal, and consider throwing in some unexpected “attractive” attributes.

At the end of the day, companies need to have a business-centric, thoughtful approach to customer experience. My suggestion, follow the three principles of Experience-Based Differentiation:

- Obsess about customer needs, not product features

- Reinforce the brand with every interaction, not just communications

- Treat customer experience as a competence, not a function

The bottom line: The path to excellence does not start with the goals of mediocrity.

This blog post was originally published by Temkin Group prior to its acquisition by Qualtrics in October 2018.