Companies spend a lot of money on market research; millions or tens of millions of dollars annually for large organizations. What do most companies get for those vast investments? Lots of data, a handful of insights, a glimmer of actionable insights, and woefully few people taking action and making decisions based on good customer insights.

One of the worst culprits are corporate satisfaction and relationship tracking studies. Companies get charts delivered either quarterly or annually about how customers rate them, they review those results at the executive level, they make some pronouncements about what it all means, and then they go back to doing exactly what they were doing — hoping for better results when the next set of Powerpoint slides are delivered. Does this sound familiar? Something’s broken!

Market research processes and practices (used by both vendors and internal organizations) operate based on several outdated assumptions of the world including these:

- Data and insights provide value

They don’t. What provides value is having people make more customer-insightful decisions and take more customer-insightful actions. - Companies have limited access to information about customers

They don’t. There’s a wealth of information available about customers beyond periodic surveys from sources like call center records, interaction data, employee feedback, and social media. - There’s no easy way to analyze unstructured data

There is. The primary tools of market research organizations have been multiple choice survey questions. Why? Because that was all they could easily analyze. Text analytics tools are making it easier to mine sentiment, topics, and other key data from the rich vein of unstructured data. - Meaningful insights require deep analysis

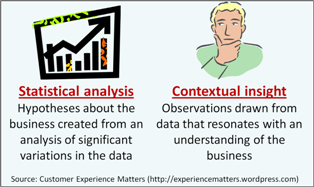

They don’t. If you don’t understand the business, then you need a lot of data and statistically significant results to draw conclusion. People across the company have context for interpreting and using much less data. That’s why I introduced the term “contextual insight.”

In a recent Temkin Group report, we identified 20 best practices for voice of the customer programs. Most of these practices are based on a changing set of assumptions around market research. The report ends with a section called “Market Research Organizations Need An Overhaul” which outlines these four areas that market research organizations need to focus on to keep from becoming obsolete:

- More focus on actions and less focus on data. Market research organizations often viewed their deliverables as reports or analysis. But VoC programs show that the focus needs to be more on actionable insights. Making this transition will require a deeper understanding of the business needs of the organization.

- More ongoing support and less discrete projects. Leading VoC programs deliver continuous insights throughout the company. So market research groups will need to provide an ongoing level of support to business partners/clients and adjust their staffing and funding models away from project-based work.

- More consulting advice and less generic presentations. Successful VoC programs require consulting to help business partners understand how to use the insights. Traditional market research analysts don’t often have the required skill sets for this effort.

- More distributed access and less centralized control. Market research organizations have traditionally controlled all of the data; sharing periodic outputs. But VoC programs will increasingly distribute information and insights across the organization. So market research groups must learn to give up control and embrace and facilitate this distributed model.

The bottom line: Customer insights are an under-tapped asset

This blog post was originally published by Temkin Group prior to its acquisition by Qualtrics in October 2018.