As part of our latest global consumer study, Qualtrics XM Institute asked over 28,000 people across 26 countries how they responded to their recent bad experience(s). We then calculated how their changed spending behavior affects different industries. Our analysis reveals that:

- Governments disappoint the most. Consumers reported experiencing a bad customer experience most often with government agencies (26%) and least often with supermarkets (6%).

- Fast food loses the most sales. After a bad experience, consumers are most likely to stop or decrease spending with fast food restaurants and least likely to cut back their interactions with public utilities (64%).

- Automotive dealers shed the most customers. After a bad experience, consumers are most likely to stop doing business completely with an auto dealer (22%) and least likely to stop doing business with public utilities (6%) and supermarkets (6%).

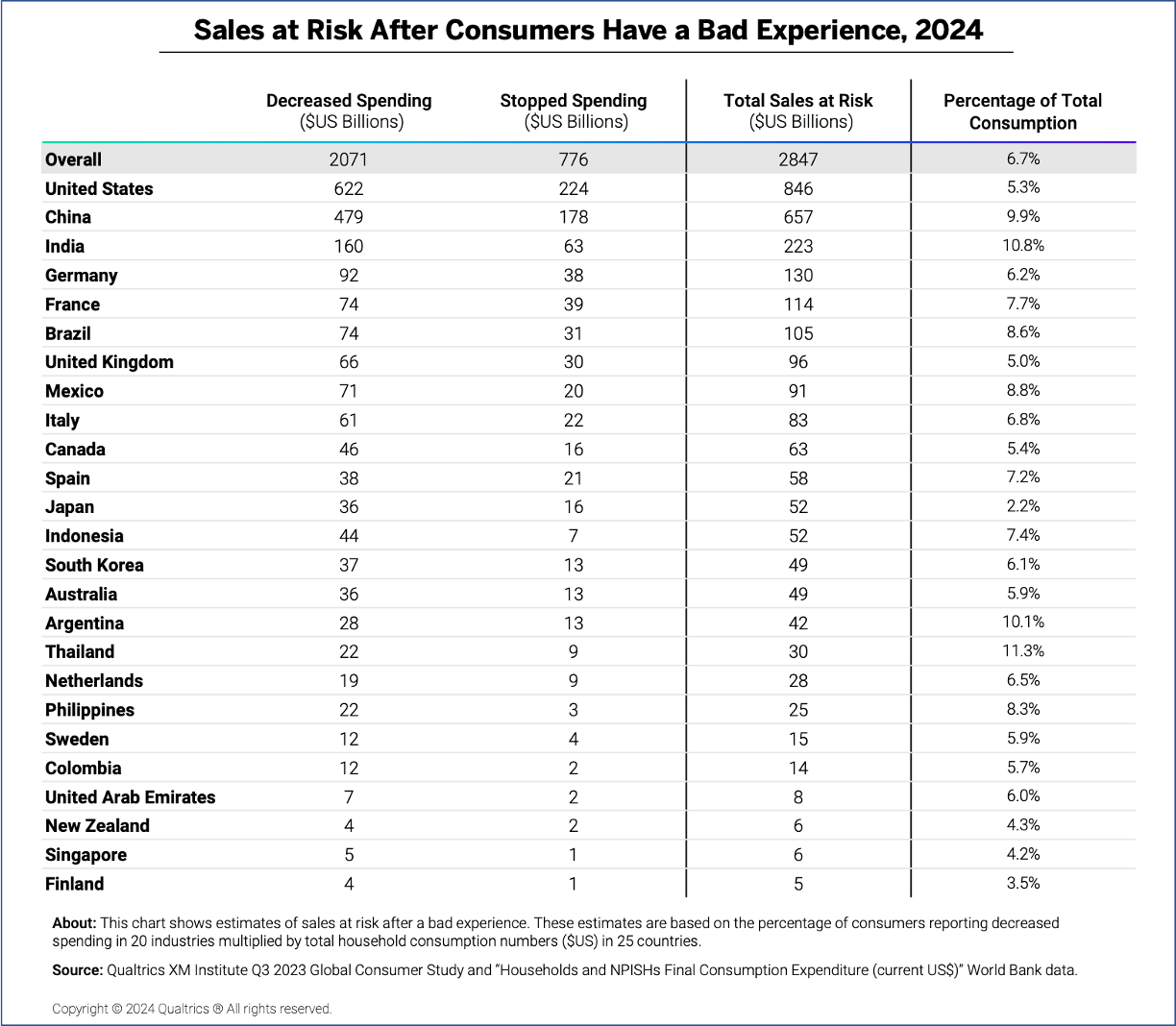

Cost of a Bad Experience Across 25 Countries

Using both the data from this study and the World Bank, we estimate that companies within the 25 countries studied are putting a whopping $2.8 billion of sales at risk1. To estimate this number, we measured:

- Frequency of bad experiences. Fourteen percent of consumers report bad experiences with the companies they interact with. Across countries, this ranges from 6% in Japan to 26% in India.

- Spending changes after a bad experience. Consumers decreased spending after a thirty-eight percent of poor experiences, while consumers stopped spending with a company entirely after another 13% of negative experiences. Across countries, the percentage that either reduces or stops spending with a company ranges from 37% in New Zealand to 63% in France.

- Sales at risk (percentage). When we multiply the percentage of poor experiences and the percentage of consumers who have cut back or stopped spending, we end up with an overall level of “sales at risk” of 7%. Across countries, the percentage of “sales at risk” ranges from 2% in Japan to 11% in India and Thailand.

- Sales at risk (currency). To translate the percentages into currency, we multiplied the sales at risk percentages for each country by household consumption numbers from The World Bank (in $US). Across 25 countries, we found a total of $2.8 trillion of sales at risk due to bad experiences, ranging from $5 billion in Finland to $846 billion in the U.S.

The Global Impact: $3.7 Trillion at Risk

Once we estimated sales at risk in 25 countries, we examined the impact of poor experiences globally. To do so, we again consulted the World Bank data. It turns out that our 25 countries represent 78% of global household consumption. If we assume that sales at risk data for the rest of the world are equivalent to that of our 25 countries, then we find that there are $3.7 trillion of sales at risk from bad experiences in 2024. In total:

- Consumers will stop spending $1 trillion with companies that provide very poor customer experiences.

- Consumers will reduce $2.7 trillion of their spending with companies that provide very poor customer experiences.

So What’s Changed?

A little over a year ago, we estimated that there was a global $3.1 trillion at risk from poor experiences. What’s different in 2024? We found that consumers are:

- Spending more. Since the publication of our previous analysis, the world’s total household consumption expenditure jumped by over 7.7 trillion – which means more revenue that can be put at risk.

- Reporting fewer bad experiences. Compared to last year, consumers report encountering bad customer experiences 2.2 percentage points less frequently. Poor experiences have decreased the most among airlines (-10 pp), property insurers (-8 pp), and universities (-8 pp).

- Reacting more severely to poor experiences. Across the 20 industries surveyed both years, the percentage of poor interactions after which consumers stopped or reduced spending has increased by 1.6 percentage points. The largest increases come from fast food (+5 pp), followed by parcel delivery services, auto dealers, and airlines (+4 pp).

The bottom line: Bad experiences come with a (growing) cost.

Talia Quaadgras is a Research Program Manager with XM Institute

Bruce Temkin, XMP, CCXP, is the Head of Qualtrics XM Institute

- We subtracted five countries and added two different countries to our 2023 global consumer study, comprising 26 countries with a total of 28,400 respondents globally. We did not include Hong Kong in our analysis this year due to small sample sizes.