Understanding the State of CX in the Retail Industry

How does the quality of customer experience differ across industries? To address this question, the XM Institute conducted a large-scale benchmark study where we asked 10,000 U.S. consumers to rate their recent interactions with 294 organizations across 20 industries.1 In this Industry Snapshot, we examine the state of CX in the retail industry. To develop this Industry Snapshot, we:

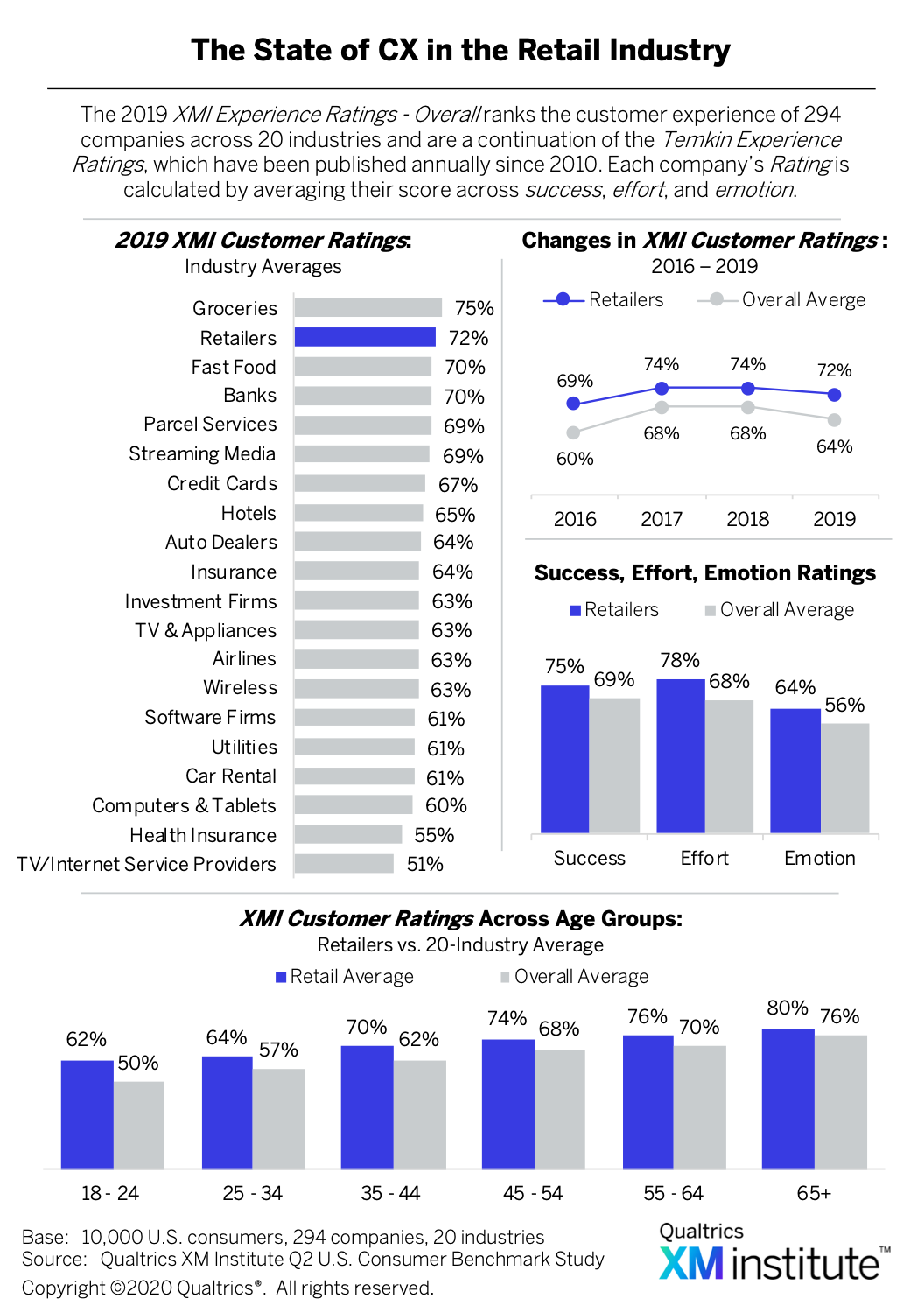

- Found the average XMI Customer Ratings – Overall for each industry. To generate the average CX rating for each industry, we asked respondents to evaluate their experiences with companies over the past 90 days.2 These questions – rated on a seven-point scale – covered the three components of an experience: success (were they able to accomplish their goals?), effort (how easy or difficult was it for them to accomplish their goals?), and emotion (how did the interaction make them feel?).3 We found the XMI Customer Rating – Overall for each of the 294 companies by averaging the ratings for these three experience components. We then calculated the average Customer Rating for each industry by averaging the Customer Ratings of the companies within each industry.4

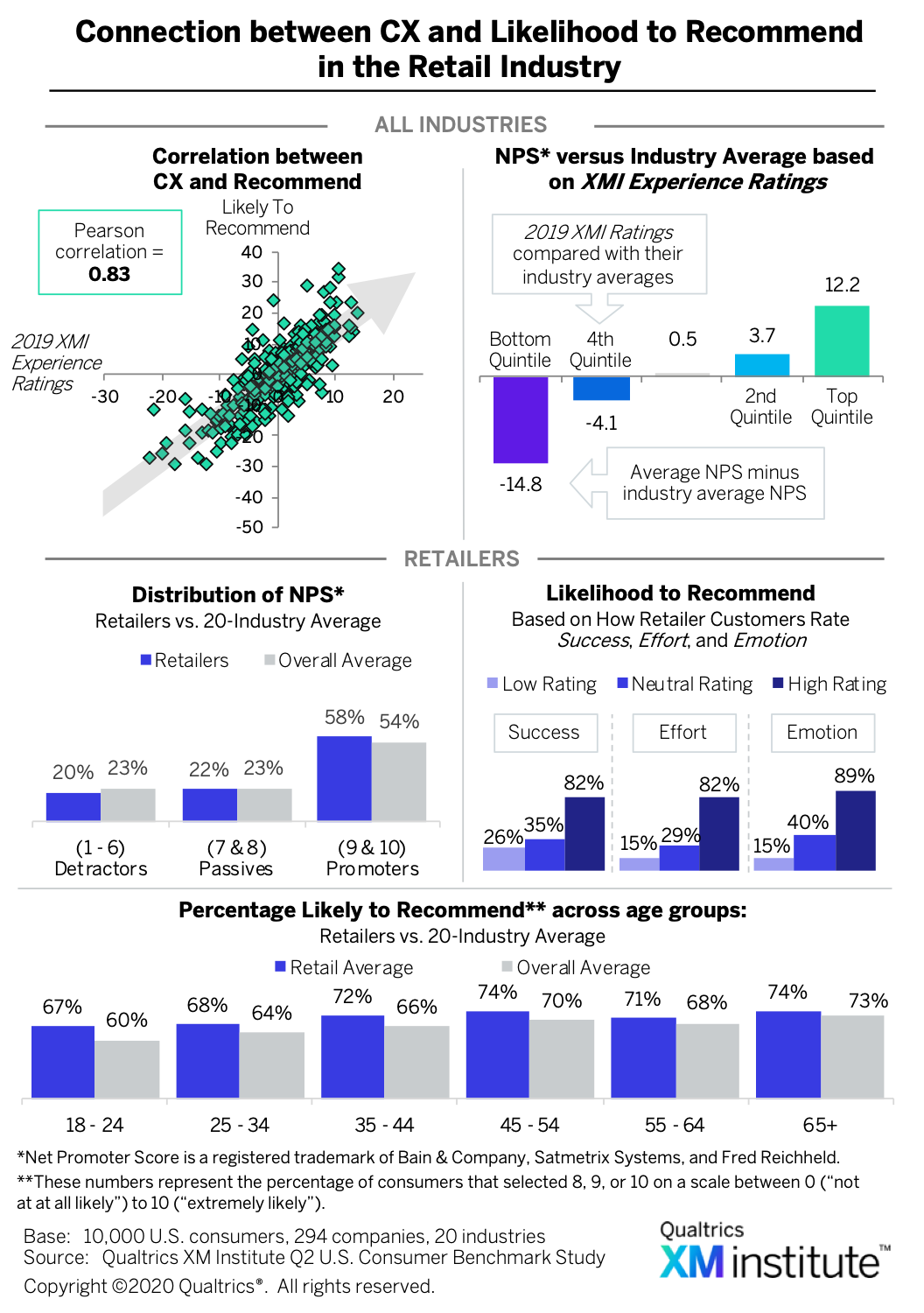

- Calculated NPS. We asked respondents who had interacted with a company to answer the standard Net Promoter® Score (NPS®) question: How likely are you to recommend <company> to friends and colleagues? Consumers selected a response from 0 (not at all likely) to 10 (extremely likely). We then determined the percentages of each firm’s respondents who were promoters (selected 9 or 10), passives (selected 7 or 8), or detractors (selected between 0 and 6). We then calculated the NPS for each company by subtracting its percentage of detractors from its percentage of promoters.5

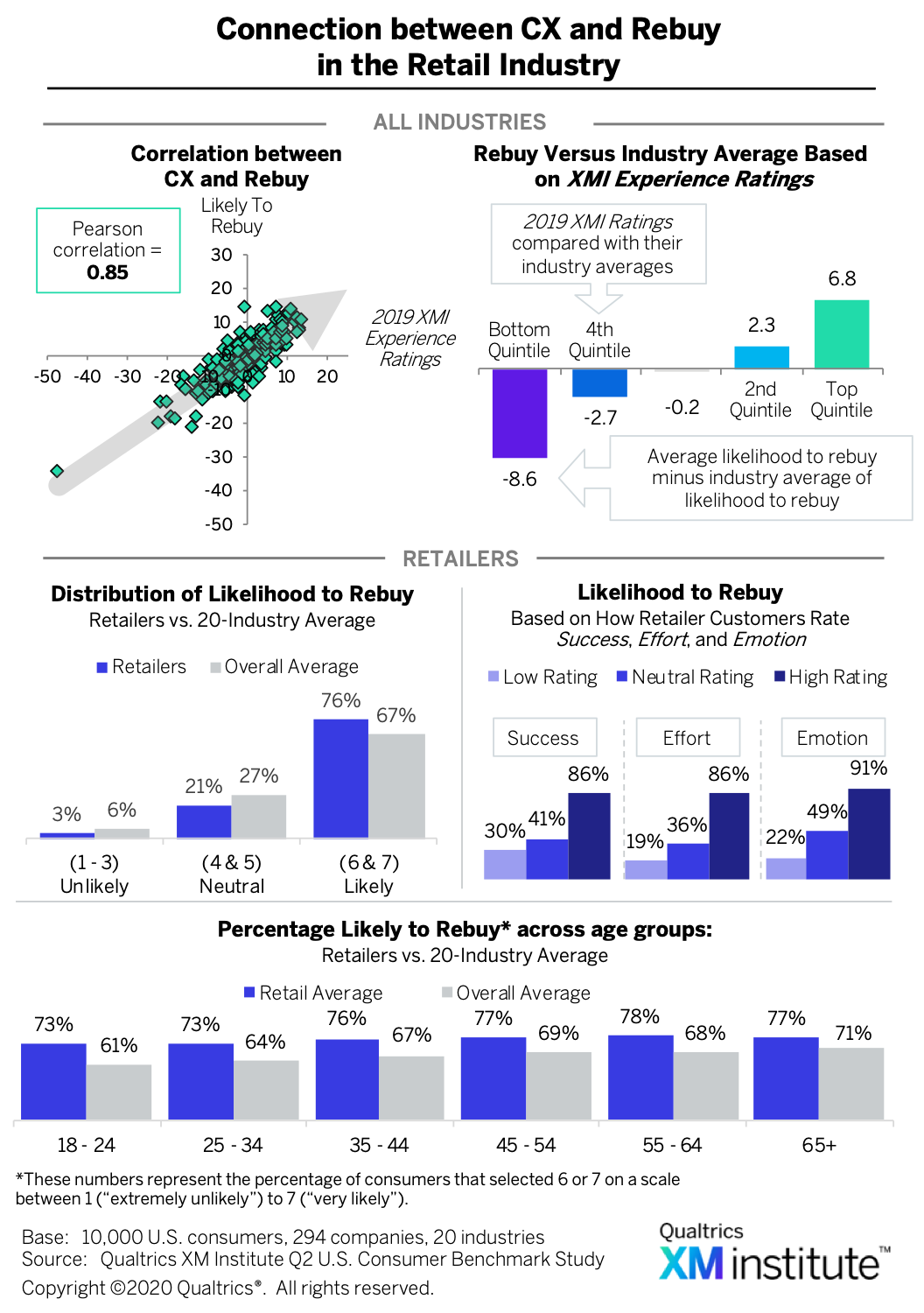

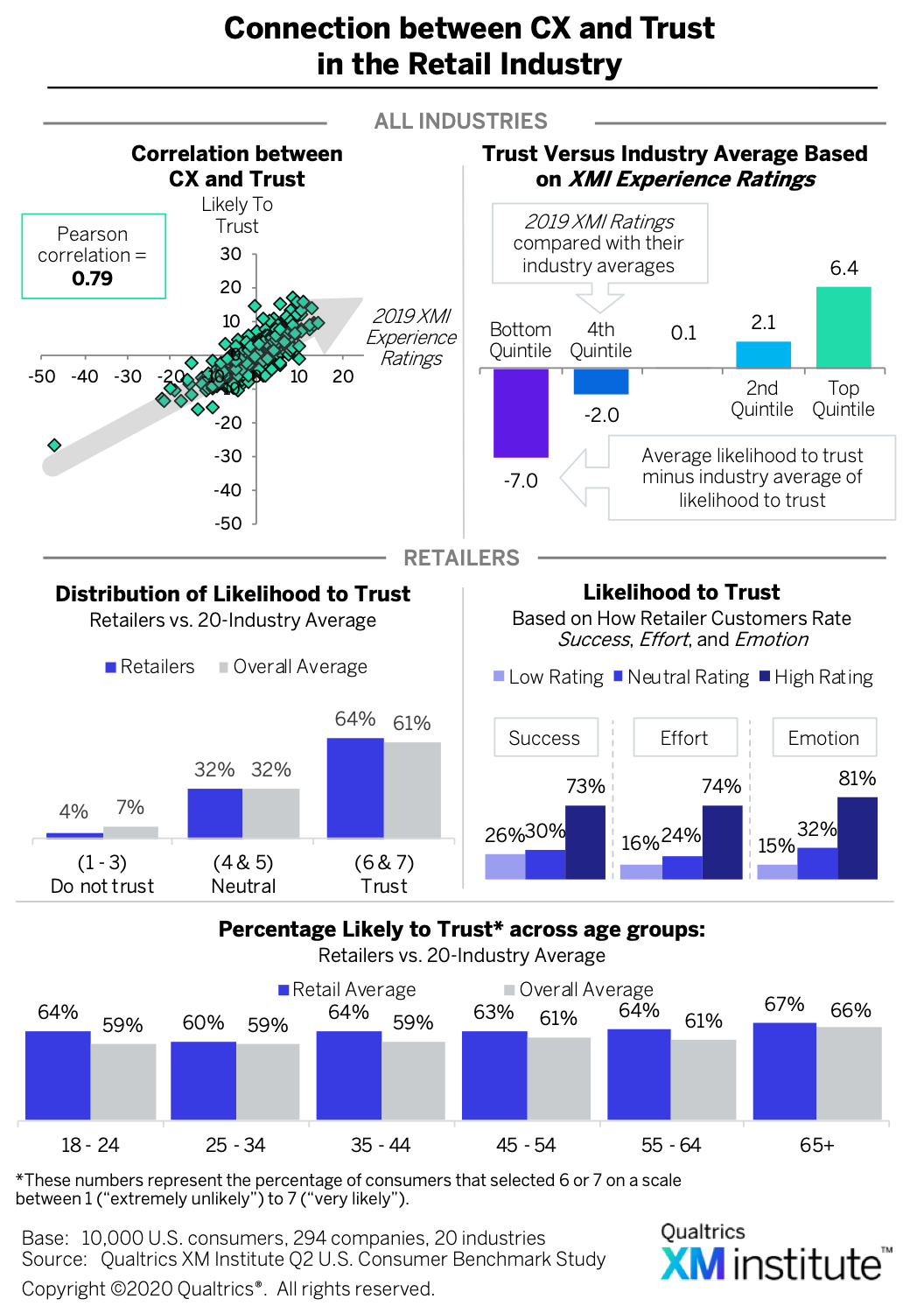

- Determined likelihood to repurchase and trust. We also asked consumers how likely they are to consider purchasing more products or services from the companies they had interacted with on a scale of 1 (extremely unlikely) to 7 (extremely likely). We also asked how likely they are to trust that the company would take care of their needs on a scale from 1 (do not trust at all) to 7 (completely trust).

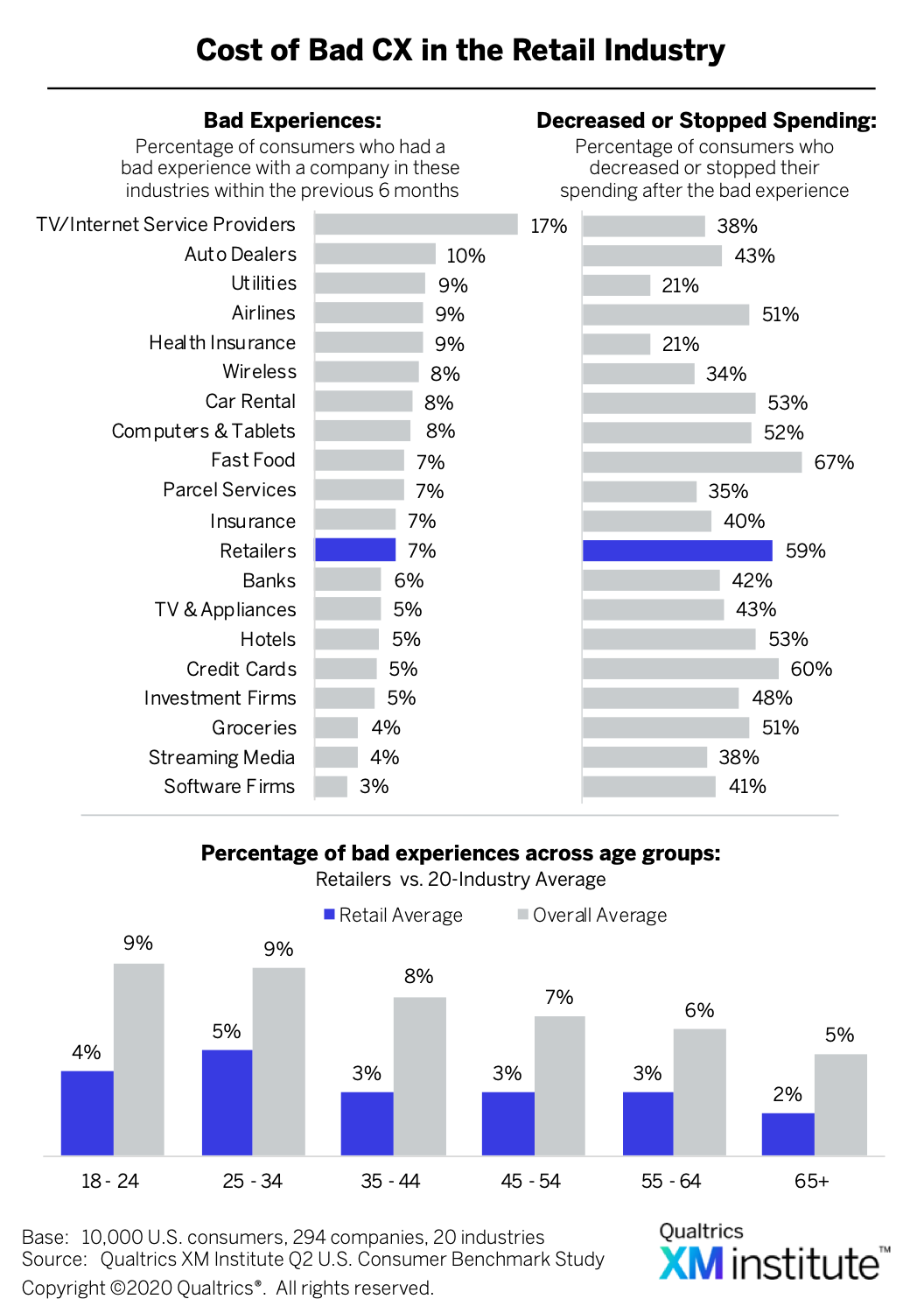

- Established the frequency and effects of poor experiences. We asked respondents to identify which organizations they recently had a poor experience with and then asked, “Since the time that you had a bad experience with these companies, how have you changed the amount of money you spend with them?” They could answer that their spending completely stopped, it decreased, it didn’t change, it increased, or that they haven’t spent any money with that company.

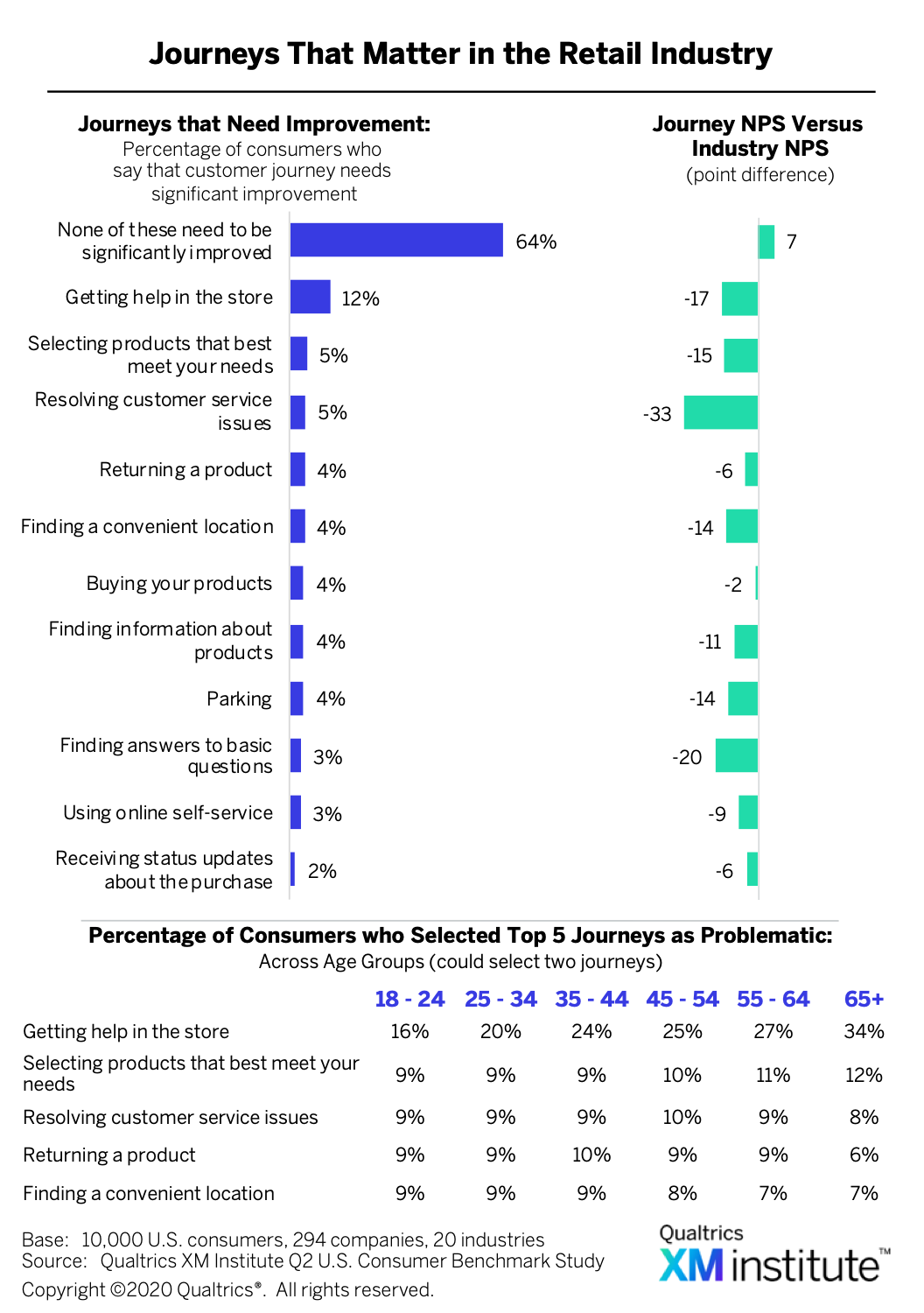

- Identified the most broken customer journeys. To better understand which types of interactions are most likely to affect the customer’s perception of an organization, we asked respondents to identify which journey within a certain industry needs the most improvement. We also looked at the correlation between which journeys a customer identified as broken and how likely that customer was to recommend the company.

Retailers Deliver Good CX

When we looked at the current state of customer experience in the retail industry and how it compared to the broader CX landscape, we found that retailers:

- Earn high Customer Ratings scores. Retailers earned an average XMI Customer Rating – Overall score of 72%, the second highest of any industry included in this study

. When we looked at how retailers performed across the three components of an experience – success, effort, and emotion – compared to the average of all 20 industries, we found that while they received above average scores across all three elements, they outpaced the cross-industry average the most in the effort component.

. When we looked at how retailers performed across the three components of an experience – success, effort, and emotion – compared to the average of all 20 industries, we found that while they received above average scores across all three elements, they outpaced the cross-industry average the most in the effort component. - Enjoy positive word-of-mouth. We found a strong connection between customers’ experiences and their likelihood to recommend a company. Companies that significantly outperformed their industry’s average XMI Customer Ratings also earned a significantly higher-than-average NPS

. Given retailers’ high Customer Ratings scores, it is therefore no surprise that the industry has more promoters and fewer detractors than the 20-industry average. To boost their number of promoters even further, retailers should focus on the emotion component of experiences as, of the three elements of an experience, that one has the most significant impact on a customer’s likelihood to recommend, with 89% of customers who gave a retailer a high emotion rating saying that they would recommend the company.

. Given retailers’ high Customer Ratings scores, it is therefore no surprise that the industry has more promoters and fewer detractors than the 20-industry average. To boost their number of promoters even further, retailers should focus on the emotion component of experiences as, of the three elements of an experience, that one has the most significant impact on a customer’s likelihood to recommend, with 89% of customers who gave a retailer a high emotion rating saying that they would recommend the company. - Particularly appeal to younger consumers. Customer experience is strongly related to a consumer’s likelihood to rebuy from a company – with a correlation coefficient of 0.85 – which likely explains why retail customers are so enthused about purchasing more from retailers

. And while all age groups say that they are more likely to rebuy from retailers compared to the cross-industry average, retailers particularly distinguish themselves from the pack with younger consumers. The percentage of 18- to 24-year-olds who say that they’ll likely repurchase from a retailer is 12 percentage-points higher than for the overall average – the largest gap for any age group.

. And while all age groups say that they are more likely to rebuy from retailers compared to the cross-industry average, retailers particularly distinguish themselves from the pack with younger consumers. The percentage of 18- to 24-year-olds who say that they’ll likely repurchase from a retailer is 12 percentage-points higher than for the overall average – the largest gap for any age group. - Inspire trust. While a customer’s experience with a company does impact their likelihood to trust that company, the correlation is slightly weaker than it is for their likelihood to recommend or repurchase

. Retailers outperform the 20-industry average for trust, with 64% of retail customers saying that they trust the company to take care of their needs. And while customers of every age trust retailers more than the general industry average, this difference is most prominent with 18- to 24-year-olds and 35- to 44-year-olds.

. Retailers outperform the 20-industry average for trust, with 64% of retail customers saying that they trust the company to take care of their needs. And while customers of every age trust retailers more than the general industry average, this difference is most prominent with 18- to 24-year-olds and 35- to 44-year-olds. - Pay a price for poor experiences. Only 7% of customers who interacted with a retailer over the previous six months say they had a bad experience

. However, of those customers who did endure a poor experience, 59% of them say that they either decreased or stopped spending after that poor interaction, which is higher than almost any other industry.

. However, of those customers who did endure a poor experience, 59% of them say that they either decreased or stopped spending after that poor interaction, which is higher than almost any other industry. - Struggle to help in-store customers. Twelve percent of retail customers identified “getting help in the store” as in need of significant improvement

. Customers who selected this journey as broken had an average NPS that was 17 points lower than the industry average. And while only 5% of customers selected “resolving customer service issues” as the most in need of improvement, those who did gave retailers an average NPS that was 33 points lower than industry’s average.

. Customers who selected this journey as broken had an average NPS that was 17 points lower than the industry average. And while only 5% of customers selected “resolving customer service issues” as the most in need of improvement, those who did gave retailers an average NPS that was 33 points lower than industry’s average.

Propel Your Customer Experience to the Next Level

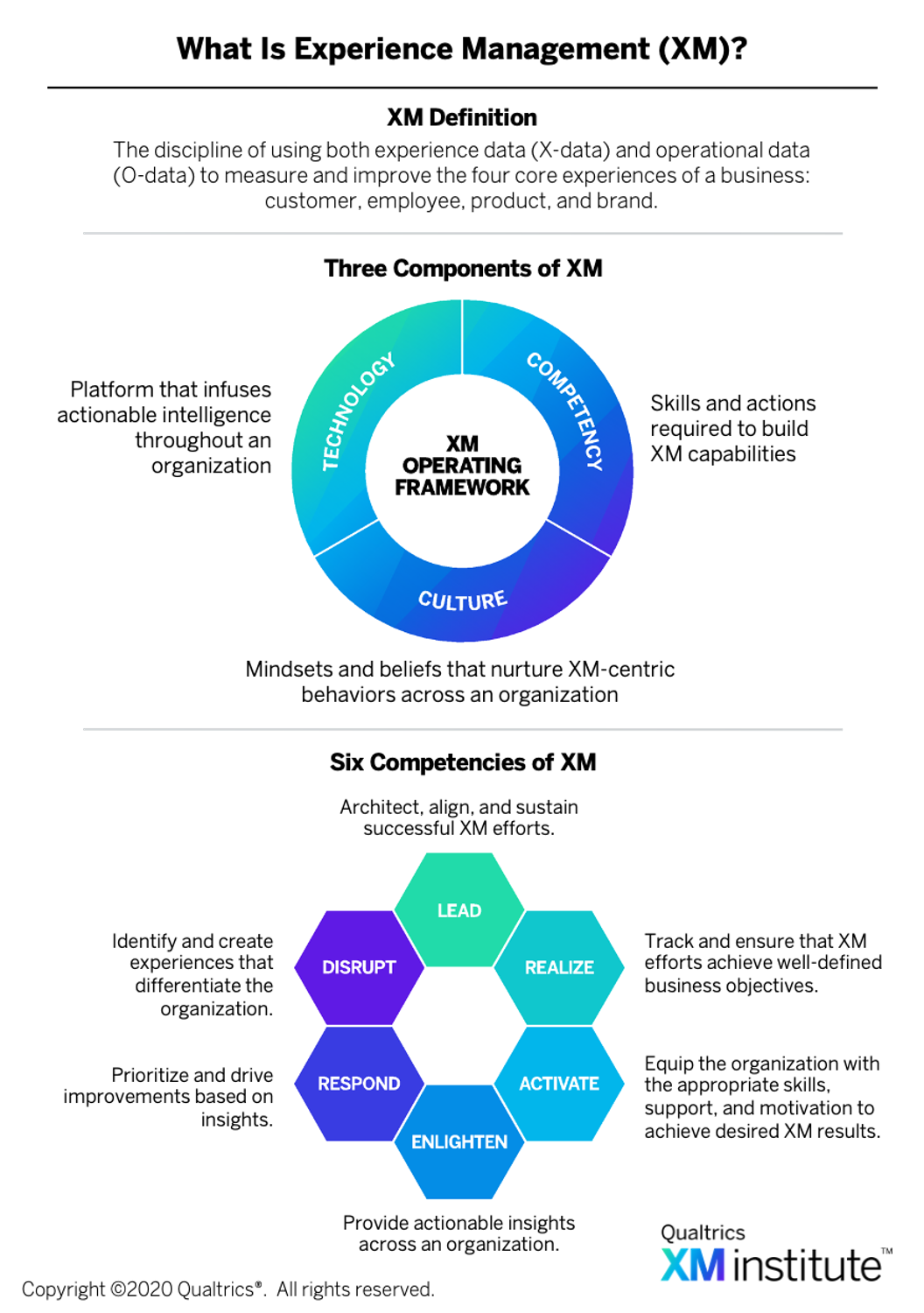

As more customers choose to shop online and advances in machine learning enable more personalized interactions, consumers expect increasingly immediate, relevant experiences from retailers. To set themselves apart and keep up with growing expectations, retailers must establish Experience Management (XM) as an organizational discipline by mastering six XM Competencies and 20 XM Skills  .6 These capabilities will help retailers succeed in the new business environment by allowing them to:

.6 These capabilities will help retailers succeed in the new business environment by allowing them to:

- Continuously learn. Retailers with strong XM Competencies and Skills will be able to continuously collect and analyze feedback and behavioral signals from the people who interact with them – gathering the information necessary for understanding the experiences, perceptions, and attitudes of their customers, employees, and prospects. For example, retailers with robust XM capabilities will be able to identify which moments most affect the loyalty of key customer segments – such as getting help in-store or returning a product – and then establish listening posts that collect ongoing insights about the quality of those interactions. These insights will include experience data (X-data) like NPS or satisfaction scores as well as operational data (O-data) like loyalty status or demographic information. Retailers who are capable of combining these two types of data will be able to more accurately forecast the value of CX improvements and gain a deeper understanding of their customers’ actual experiences. For instance, a retailer may find that older customers tend to give it lower satisfaction scores after visiting a store because they expect employees to be more attentive and helpful.

- Propagate insights. Once retailers understand how the people who interact with them think, behave, and feel, they then need to get those insights into the hands of the people across their ecosystems who are best equipped to act on that information. For example, retailers with strong XM skills will not only recognize that, say, getting help in the store is an important moment for customers, they will also be able to quickly share qualitative and quantitative insights about these interactions with the people who are directly and indirectly responsible for delivering them, such as frontline employees and store managers. Furthermore, they will tailor both the content and the form of these insights for each role, with customized alerts triggered when certain criteria – such as a low score for friendliness or helpfulness – are met.

- Rapidly adapt. Distributing customer insights in the right form to the right people across the organization will allow retailers to act quickly on the intelligence they’ve collected and shared, thus enabling them to rapidly create or improve experiences in a way that addresses people’s changing needs and expectations. For example, customers’ feedback may highlight that determining which shoe size to order online is a key pain point, so the retailer may consider adding a feature into their app that allows customers to scan their foot and receive personalized recommendations.

- Data comes from the Qualtrics XM Institute Q2 2019 Consumer Benchmark Survey – an online study of 10,000 U.S. consumers completed during May 2019. Survey respondents were representative of the U.S. Census based on quotas for age, income, ethnicity, and geographic region.

- See the XM Institute report, “2019 XMI Customer Ratings – Overall,” (September 2019). The XMI Customer Ratings – Overall are a continuation of the Temkin Experience Ratings. The Ratings were renamed after Qualtrics purchased Temkin Group in October 2018.

- We developed ratings for each of the three components of an experience – success, effort, and emotion – by subtracting the percentage of consumers who rated a company poorly from the percentage of consumers who rated it highly.

- Although consumers rated a number of companies for our survey, we only analyzed the ones that received at least 100 consumer responses. Ultimately, we examined data from 294 companies across 20 industries. For this Industry Snapshot, data on retailers comes from over 11,300 respondents evaluating their experiences with 45 large retail companies.

- See the XM Institute report, “2019 XMI Customer Ratings – Consumer NPS,” (October 2019).

- See the Qualtrics XM Institute report, “Operationalizing XM” (July 2019).