Understanding the State of CX in the Insurance Industry

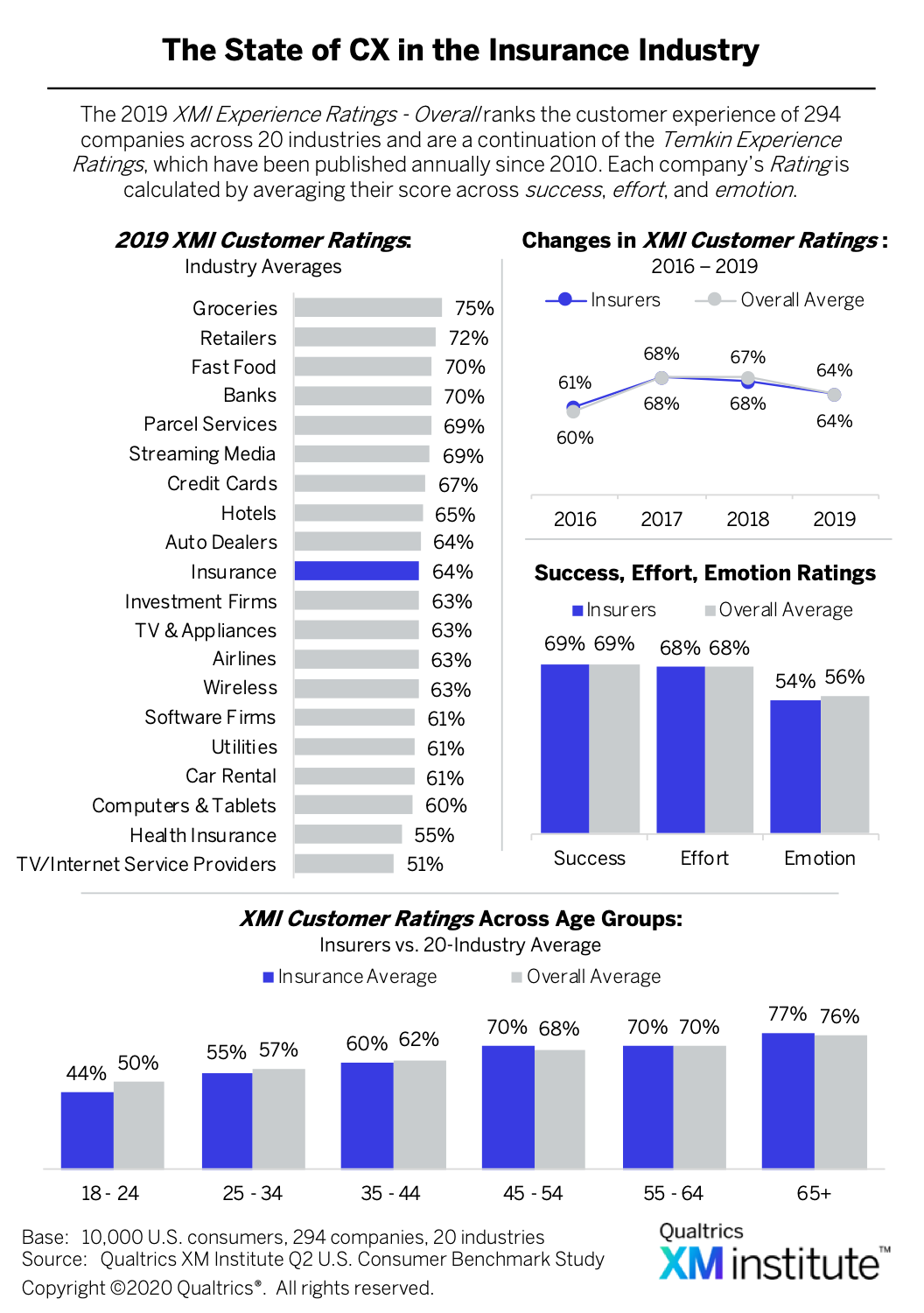

How does the quality of customer experience differ across industries? To address this question, the XM Institute conducted a large-scale benchmark study where we asked 10,000 U.S. consumers to rate their recent interactions with 294 organizations across 20 industries.1 In this Industry Snapshot, we examine the state of CX in the insurance industry. To develop this Industry Snapshot, we:

- Found the average XMI Customer Ratings – Overall for each industry. To generate the average CX rating for each industry, we asked respondents to evaluate their experiences with companies over the past 90 days.2 These questions – rated on a seven-point scale – covered the three components of an experience: success (were they able to accomplish their goals?), effort (how easy or difficult was it for them to accomplish their goals?), and emotion (how did the interaction make them feel?).3 We found the XMI Customer Rating – Overall for each of the 294 companies by averaging the ratings for these three experience components. We then calculated the average Customer Rating for each industry by averaging the Customer Ratings of the companies within each industry.4

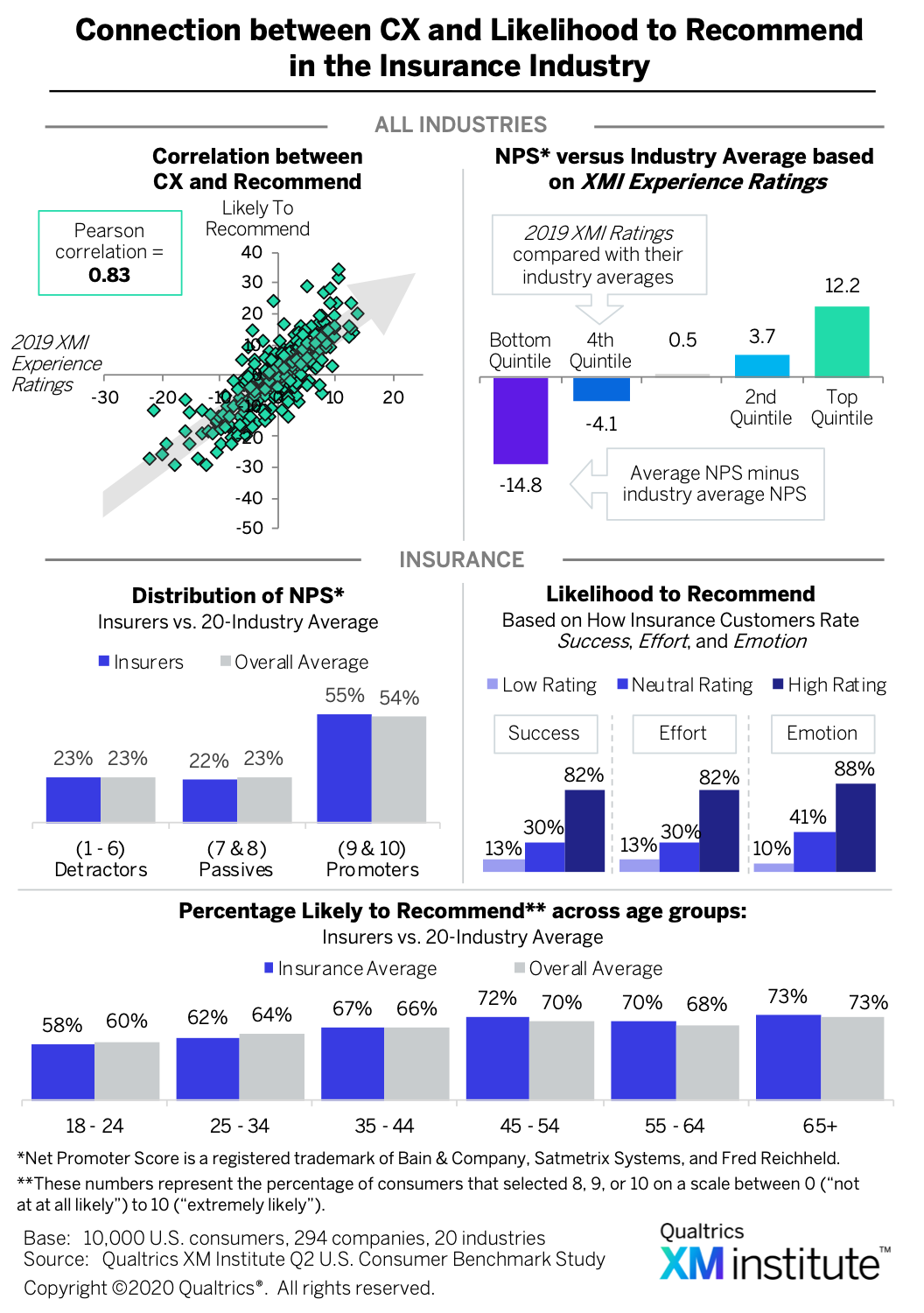

- Calculated NPS. We asked respondents who had interacted with a company to answer the standard Net Promoter® Score (NPS®) question: How likely are you to recommend <company> to friends and colleagues? Consumers selected a response from 0 (not at all likely) to 10 (extremely likely). We then determined the percentages of each firm’s respondents who were promoters (selected 9 or 10), passives (selected 7 or 8), or detractors (selected between 0 and 6). We then calculated the NPS for each company by subtracting its percentage of detractors from its percentage of promoters.5

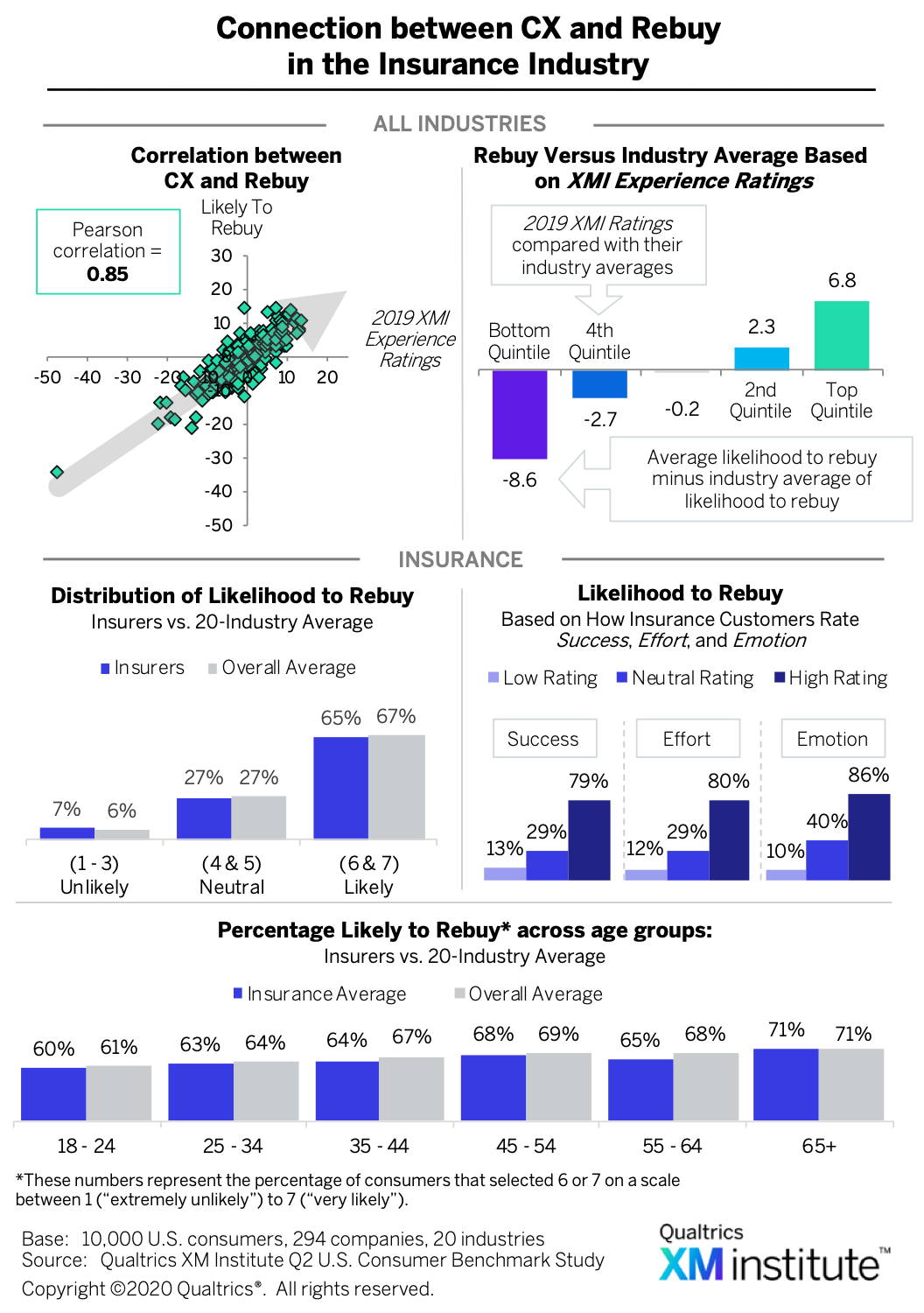

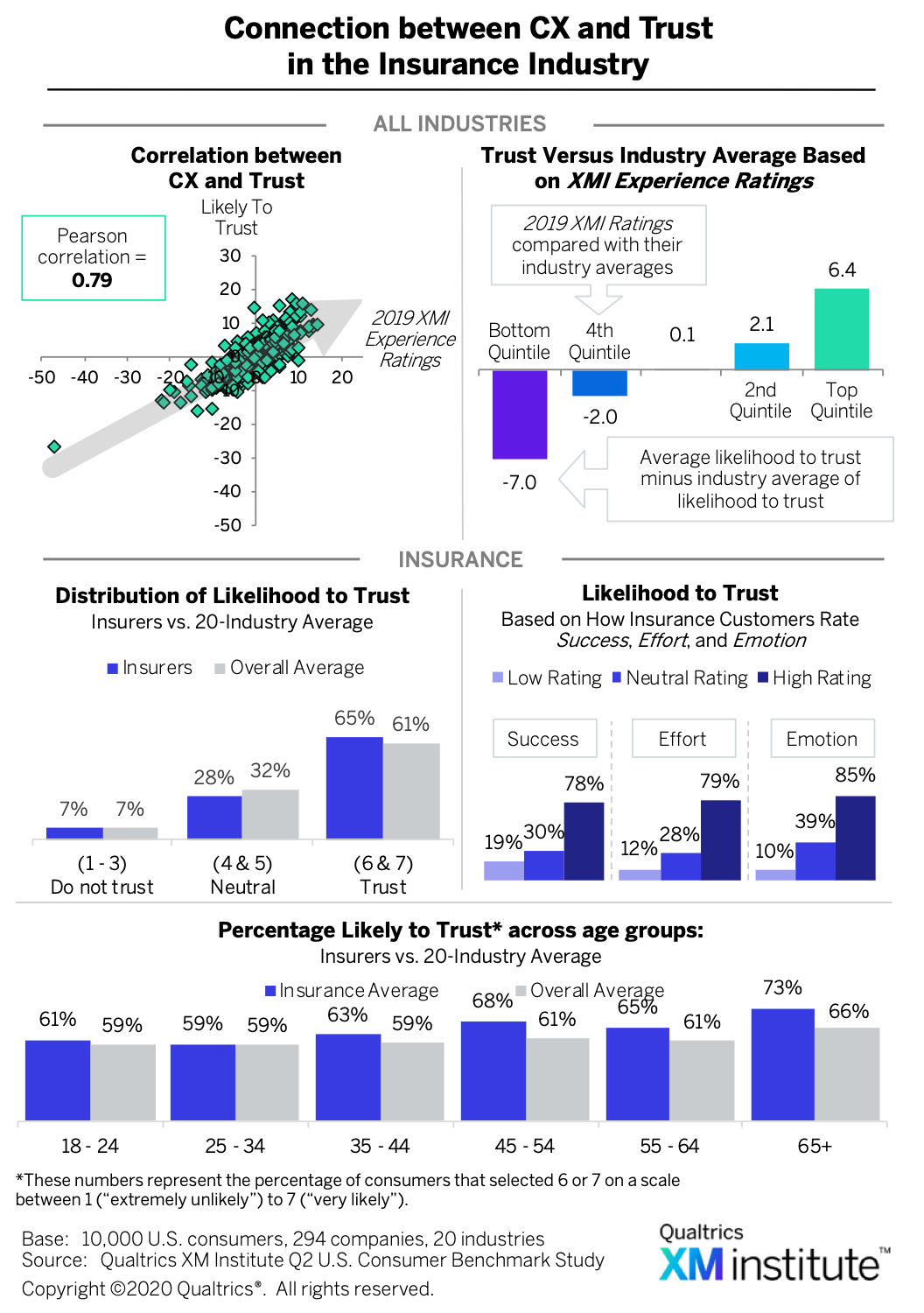

- Determined likelihood to repurchase and trust. We also asked consumers how likely they are to consider purchasing more products or services from the companies they had interacted with on a scale of 1 (extremely unlikely) to 7 (extremely likely). We also asked how likely they are to trust that the company would take care of their needs on a scale from 1 (do not trust at all) to 7 (completely trust).

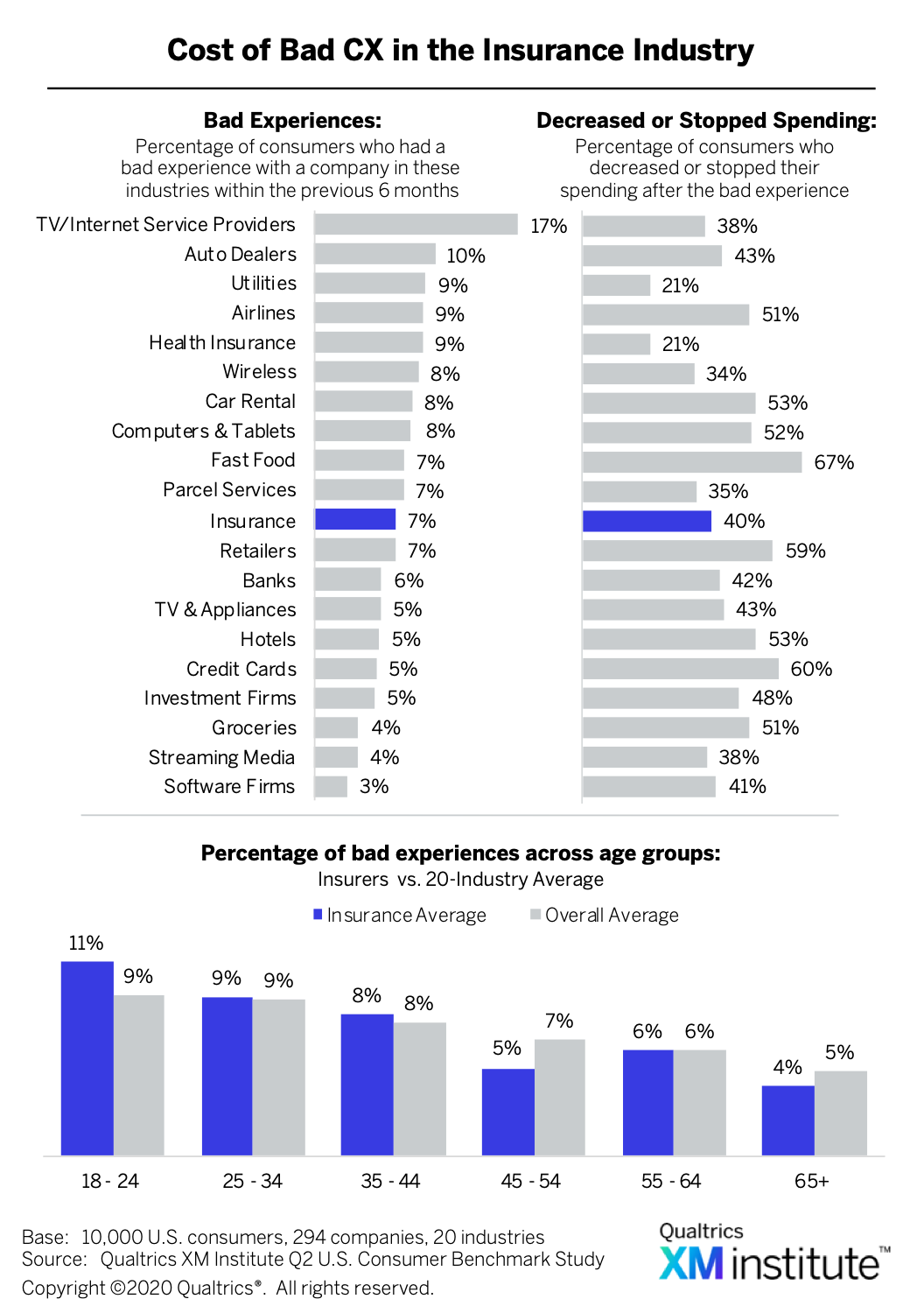

- Established the frequency and effects of poor experiences. We asked respondents to identify which organizations they recently had a poor experience with and then asked, “Since the time that you had a bad experience with these companies, how have you changed the amount of money you spend with them?” They could answer that their spending completely stopped, it decreased, it didn’t change, it increased, or that they haven’t spent any money with that company.

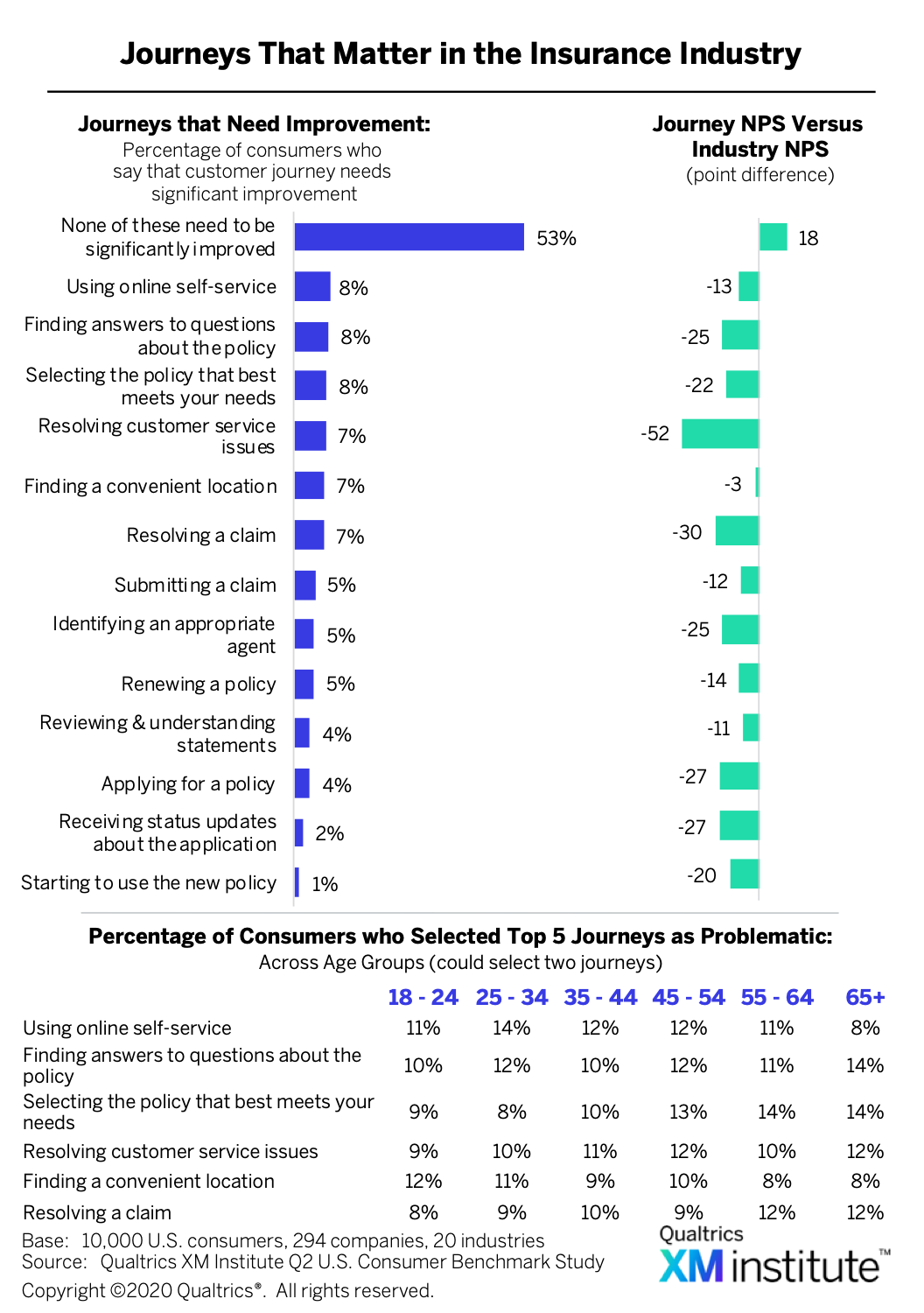

- Identified the most broken customer journeys. To better understand which types of interactions are most likely to affect the customer’s perception of an organization, we asked respondents to identify which journey within a certain industry needs the most improvement. We also looked at the correlation between which journeys a customer identified as broken and how likely that customer was to recommend the company.

Insurers Deliver Average CX

When we looked at the current state of customer experience in the insurance industry and how it compared to the broader CX landscape, we found that insurers:

- Earn average Customer Ratings scores. Insurers received an average XMI Customer Rating – Overall score of 64% and tied for 9th place out of 20 industries

. When we looked at how insurers performed across the three components of an experience – success, effort, and emotion – compared to the average of all 20 industries, we found that although they are on par with the 20-industry average for both success and effort, they lag slightly behind average when it comes to emotion. Additionally, when we looked at Customer Ratings across age groups, we found that insurers receive a significantly lower score than the cross-industry average for 18- to 24-year-olds.

. When we looked at how insurers performed across the three components of an experience – success, effort, and emotion – compared to the average of all 20 industries, we found that although they are on par with the 20-industry average for both success and effort, they lag slightly behind average when it comes to emotion. Additionally, when we looked at Customer Ratings across age groups, we found that insurers receive a significantly lower score than the cross-industry average for 18- to 24-year-olds. - Receive unremarkable Net Promoter Scores. We found a strong connection between customers’ experiences and their likelihood to recommend a company. Companies that significantly outperformed their industry’s average XMI Customer Ratings also earned a significantly higher-than-average NPS

. When we looked at NPS in the insurance industry specifically, we found that insurers’ scores are only one point higher than the overall 20-industry average. If insurers want to break away from the pack, they should focus on the emotion component of experiences as, of the three elements of an experience, it is the one that most significantly impacts a customer’s likelihood to recommend. In fact, 88% of customers who gave an insurer a high score for emotion say that they are likely to recommend the company.

. When we looked at NPS in the insurance industry specifically, we found that insurers’ scores are only one point higher than the overall 20-industry average. If insurers want to break away from the pack, they should focus on the emotion component of experiences as, of the three elements of an experience, it is the one that most significantly impacts a customer’s likelihood to recommend. In fact, 88% of customers who gave an insurer a high score for emotion say that they are likely to recommend the company. - Lack repurchase appeal. Customer experience is strongly related to a consumer’s likelihood to rebuy from a company – with a correlation coefficient of 0.85

. The insurance industry received fairly average ratings when we asked customers how likely they were to repurchase from an insurer. However, when it comes to repurchase intent, insurance companies lag behind the cross-industry average by three percentage points in two age groups: 35- to 44-year-olds and 55- to 64-year-olds.

. The insurance industry received fairly average ratings when we asked customers how likely they were to repurchase from an insurer. However, when it comes to repurchase intent, insurance companies lag behind the cross-industry average by three percentage points in two age groups: 35- to 44-year-olds and 55- to 64-year-olds. - Inspire trust in older consumers. While a customer’s experience with a company does impact their likelihood to trust that company, the correlation is slightly weaker than it is for their likelihood to recommend or repurchase

. The percentage of customers who say they trust insurers to take care of their needs is four percentage-points higher than the 20-industry average – though that lead jumps up to seven points for consumers who are between 45 and 54, four points for those between 55 and 64, and seven points for those older than 65.

. The percentage of customers who say they trust insurers to take care of their needs is four percentage-points higher than the 20-industry average – though that lead jumps up to seven points for consumers who are between 45 and 54, four points for those between 55 and 64, and seven points for those older than 65. - Deliver few poor experiences. Seven percent of customers who interacted with an insurer over the previous six months say that they had a bad experience

. However, of those customers who did endure a poor experience, 40% of them say that they either decreased or stopped spending after that poor interaction, which is fairly average across industries. Compared to other age groups, 18- to 24-year-olds are slightly more likely to say they had a bad experience with insurers, with 11% citing a recent negative interaction.

. However, of those customers who did endure a poor experience, 40% of them say that they either decreased or stopped spending after that poor interaction, which is fairly average across industries. Compared to other age groups, 18- to 24-year-olds are slightly more likely to say they had a bad experience with insurers, with 11% citing a recent negative interaction. - Struggle with self-service and explaining policies. Eight percent of customers selected “using online self-service,” “finding answers to questions about the policy,” and “selecting the policy that best meets your needs” as a journey in significant need of improvement

. While customers who selected these journeys as broken do give lower NPS scores than the overall industry average, customers who selected “resolving customer service issues” as the most broken gave insurers an NPS that was 52 points lower than the overall industry average.

. While customers who selected these journeys as broken do give lower NPS scores than the overall industry average, customers who selected “resolving customer service issues” as the most broken gave insurers an NPS that was 52 points lower than the overall industry average.

Propel Your Customer Experience to the Next Level

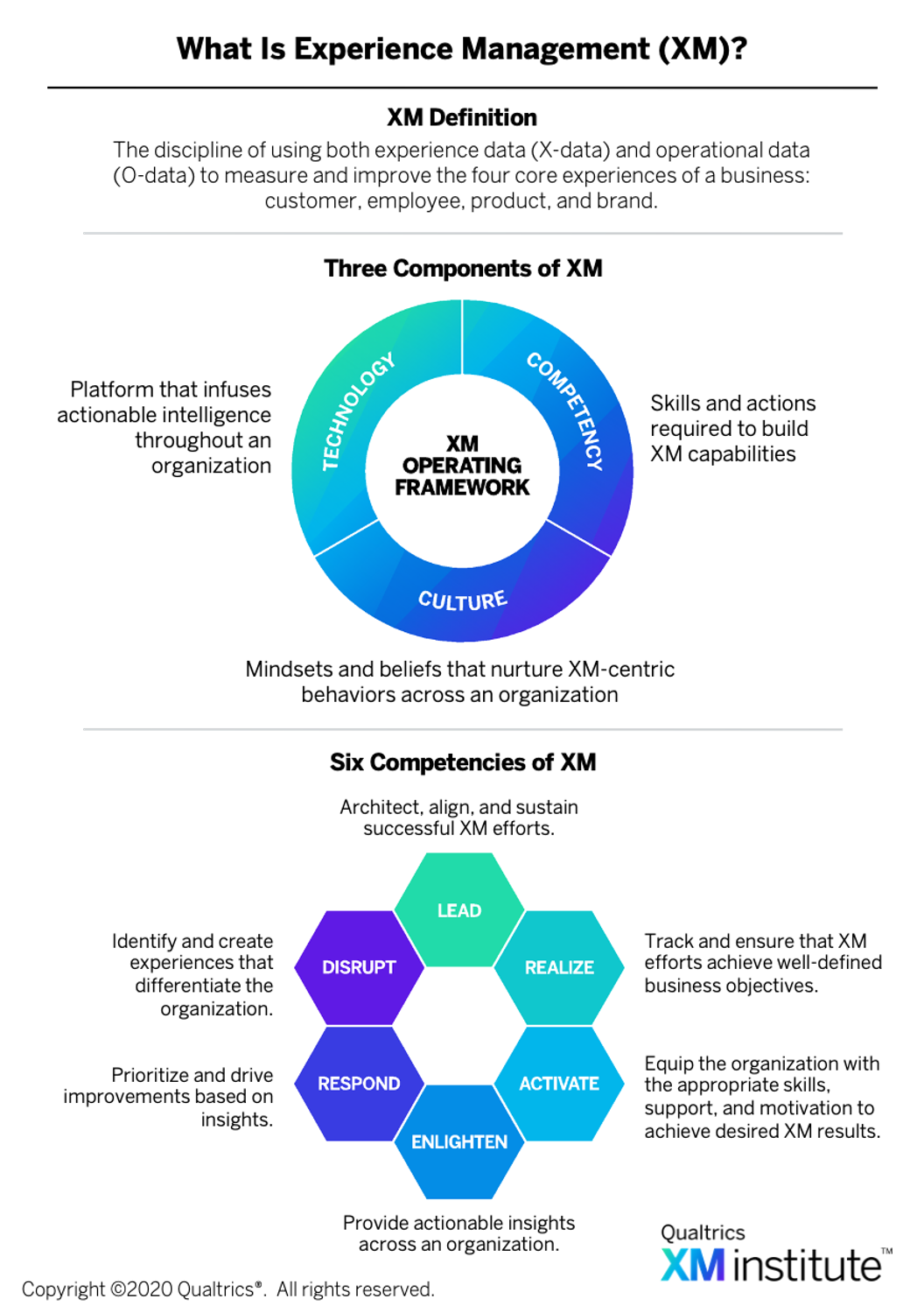

Interacting with insurance companies has traditionally been a cumbersome process; however, customers today expect simpler and more engaging experiences. To meet these rising expectations and thrive in this new landscape, insurers must establish Experience Management (XM) as an organizational discipline by mastering six XM Competencies and 20 XM Skills  .6 These capabilities will help insurers succeed by allowing them to:

.6 These capabilities will help insurers succeed by allowing them to:

- Continuously learn. Insurers with strong XM Competencies and Skills will be able to continuously collect and analyze feedback and behavioral signals from the people who interact with them – gathering the information necessary for understanding the experiences, perceptions, and attitudes of their customers, employees, and prospects. For example, insurers with robust XM capabilities will be able to identify which moments most affect the loyalty of key customer segments – such as selecting the best policy or using online self-service – and then establish listening posts that collect ongoing insights about the quality of those interactions. These insights will include experience data (X-data) like NPS or satisfaction scores as well as operational data (O-data) like policy owned or demographic information. Insurers who are capable of combining these two types of data will be able to more accurately forecast the value of CX improvements and gain a deeper understanding of their customers’ actual experiences. For instance, an insurer may find that satisfaction scores for selecting a new insurance plan are particularly low for younger customers as they find navigating through all the different options confusing and overwhelming.

- Propagate insights. Once insurers understand how the people who interact with them think, behave, and feel, they then need to get those insights into the hands of the people across their ecosystems who are best equipped to act on that information. For example, insurers with strong XM skills will not only recognize that, say, selecting a new plan is a moment of truth for customers, they will also be able to quickly share qualitative and quantitative insights about these interactions with the people who are directly and indirectly responsible for delivering them. Furthermore, they will tailor both the content and the form of these insights for each role, with customized alerts triggered when certain criteria – such as a low NPS or CSAT score – are met.

- Rapidly adapt. Distributing customer insights in the right form to the right people across the organization will allow insurers to act quickly on the intelligence they’ve collected and shared, thus enabling them to rapidly create or improve experiences in a way that addresses people’s changing needs and expectations. For example, customer feedback may highlight that finding answers to questions about their policy is a key pain point, so an insurer could deploy a virtual agent specifically designed to answer basic policy questions.

- Data comes from the Qualtrics XM Institute Q2 2019 Consumer Benchmark Survey – an online study of 10,000 U.S. consumers completed during May 2019. Survey respondents were representative of the U.S. Census based on quotas for age, income, ethnicity, and geographic region.

- See the XM Institute report, “2019 XMI Customer Ratings – Overall,” (September 2019). The XMI Customer Ratings – Overall are a continuation of the Temkin Experience Ratings. The Ratings were renamed after Qualtrics purchased Temkin Group in October 2018.

- We developed ratings for each of the three components of an experience – success, effort, and emotion – by subtracting the percentage of consumers who rated a company poorly from the percentage of consumers who rated it highly.

- Although consumers rated a number of companies for our survey, we only analyzed the ones that received at least 100 consumer responses. Ultimately, we examined data from 294 companies across 20 industries. For this Industry Snapshot, data on insurers comes from over 5,000 respondents evaluating their experiences with 13 large insurance companies.

- See the XM Institute report, “2019 XMI Customer Ratings – Consumer NPS,” (October 2019).

- See the Qualtrics XM Institute report, “Operationalizing XM” (July 2019).