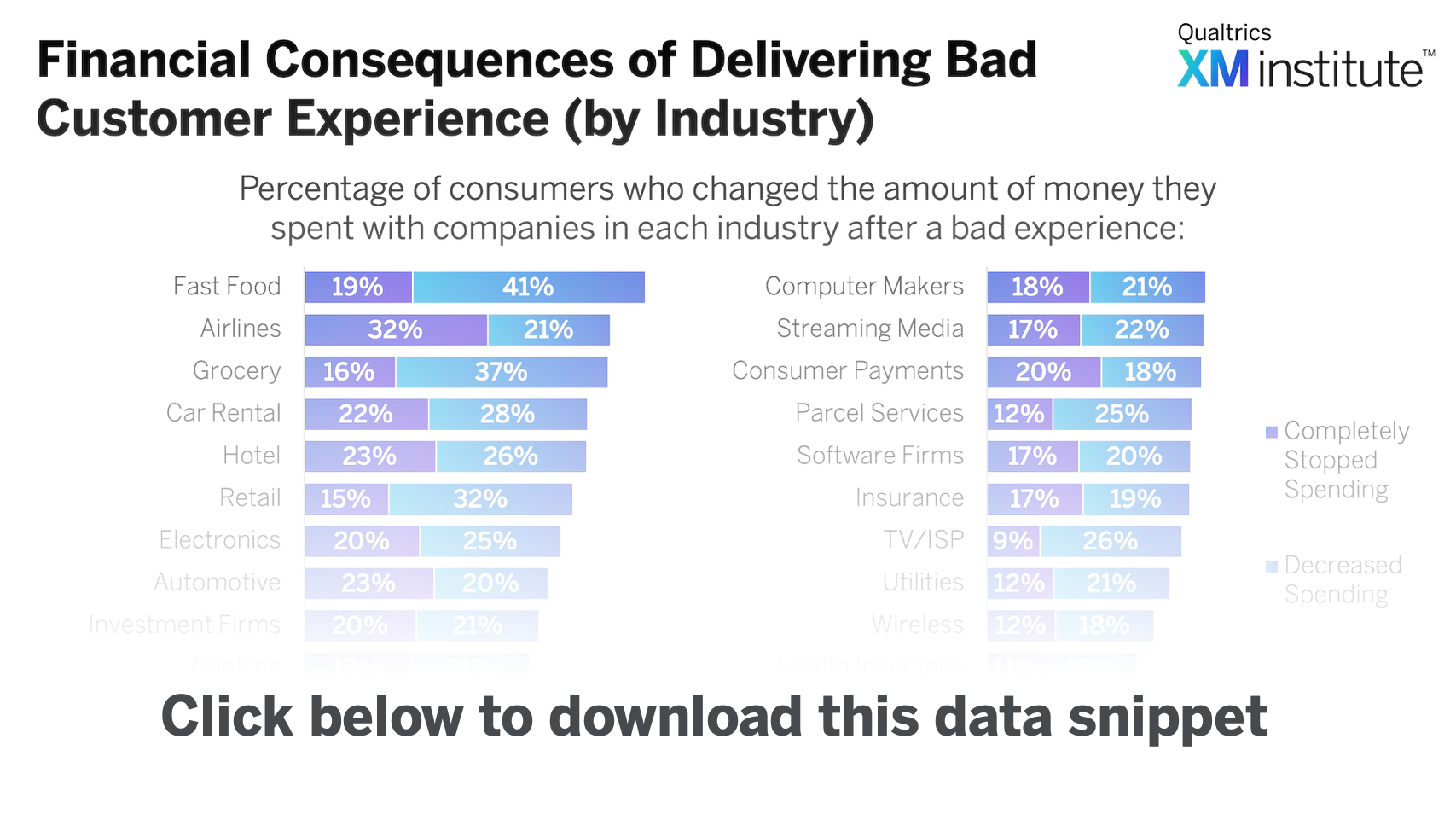

As part of our annual U.S. consumer benchmark study, we asked respondents how they change the amount of money they spend with an organization after a bad experience. Our analysis shows that, across 20 industries, consumers tend to decrease or stop spending after a poor experience. However, the financial consequences of delivering bad experiences are not equal across industries. Consumers are more likely to cut their spending with companies they have a transactional relationship with – such as fast-food restaurants, airlines, and grocery stores – than companies they have an ongoing (often contractual) relationship with – such as health insurers, wireless providers, and utilities.

The consumer benchmark study surveys a representative sample of 10,000 U.S. consumers about their interactions with 319 companies across 20 different industries. For more information on the financial impact of bad customer experiences, check out the full Data Snapshot, What Happens After a Bad Experience, 2020, which includes our Sales-at-Risk Index.

To use this Data Snippet, download and include it in presentations. The graphic is free to use but must retain the copyright notice.